There are so many reasons to keep the American Express Platinum card. The $200 yearly airline fee credit. The $100 Global Entry or $85 TSA Pre-Check credit and the annual $189 CLEAR credit. The $200 yearly UBER credits ($15 per month and an additional $20 in December). The $240 yearly digital entertainment credit. Not to mention the Centurion Lounge access. Saks Fifth Avenue credit. Equinox credit. Priority Pass and other lounge access.

There’s just one reason to cancel the card. It costs six hundred and ninety-five dollars per year.

After having the card for several years, I canceled my American Express Platinum Card in 2018.

Why would I do that when, as American Express says, I can get over $1,500 in value from the card? After all of the rebates you receive, the card pays back far more than $695 and is a no-brainer to keep.

At the time, I decided I didn’t want to pay upfront and then spend the rest of the year trying to make that money back in the form of statement credits. While some of the benefits have changed since 2018, the reasons I canceled the card are as valid today as they were back then. With the introduction of new high-end travel cards, there are even more reasons to reconsider if the AMEX Platinum is right for you.

I Have Multiple High Annual Fee Cards

I currently have the Citi Prestige ($495) and Sapphire Reserve ($550). Spending an additional $695 for the AMEX Platinum didn’t make sense since many benefits of these cards overlap, so I really needed to ask myself if I had to keep all of them.

AMEX’s Airline Fee Credit Is Hard To Use

The $200 credit on the AMEX platinum is only good for reimbursing airline fees, not airline tickets. You also have to pick which airline you want to use the credit on at the beginning of the year and you can’t change it once it’s selected. That’s not good for me since I’m not loyal to any particular travel brand, airline, or otherwise.

One thing you have to do is stop saying these credits are like getting cash. They’re not, and stop pretending that they are.

Many Cards Offer Priority Pass Membership

We have multiple Priority Pass memberships in the household. Since Sharon and I are the only ones traveling, and we usually travel together, we only need one of these memberships. The other ones have no additional value.

More Cards Offer Global Entry or TSA Precheck Credits

I thought I would use my AMEX Platinum credit to pay for my Global Entry renewal. Instead, I used my United Explorer card to cover the bill. That card only has a $95 annual fee and has the same reimbursement as the AMEX Platinum. There are now many cards that provide credits for these fees.

The UBER Credits Don’t Roll Over Monthly

The $15 monthly UBER credit is exactly that. Monthly. If you don’t use it, it’s gone. We don’t travel every month where we’re using UBER. It also works for UBER Eats, but we just ordered delivery food or planned to take an UBER, when we wouldn’t have otherwise, to use the credit. Is that useful or wasteful? Hmmmmm.

I Wasn’t Using The 5x Airfare Category

The AMEX Platinum card offers 5X Membership Rewards points for airfare booked with the card and for hotels booked through the AMEX travel portal. The problem was that I wasn’t booking a bunch of paid airfare. If I did, I was using the Sapphire Reserve, which pays 3x points per dollar and provides much better trip protection insurance than the Platinum card.

We Don’t Visit Centurion Lounges That Often

AMEX Centurion Lounges are awesome.

The problem is, we don’t visit them enough. I spent time in a Centurion Lounge twice in 2018. It was a great place to hang out, get some food, have a drink, and get some work done. With the crowding problems the lounges are having, restrictions on when you can enter, and limiting guests, it’s not worth that much to me.

You Can’t Bring A Guest Into Delta SkyClubs

This is a huge thorn for me. If I pay $695 a year for a card and travel with my spouse, why can’t we both enter a SkyClub? We finally got to enter a SkyClub when traveling on an international Delta One ticket. While it was nice, it wasn’t fabulous and definitely not worth paying the money to keep a Platinum AMEX.

I Don’t Shop At Saks Fifth Avenue

The $50 credit you get twice a year for Saks purchases is nice, but I give it no value. The swim trunks and underwear I purchased were good quality, but I could still buy them from Target or JCPenney and be just as happy.

I Don’t Value Status

AMEX Platinum provides an elevated status with Marriott and Hilton, Avis, Hertz, and National Car Rental. Sharon was already a Bonvoy Platinum member with Marriott through 2022, and Hilton Gold doesn’t give much more than a “free” breakfast (and we’ve seen how well that works at some hotels. Not.).

I Have No Remorse

Looking back, the reasons I canceled the Platinum Card are just as valid today as they were in 2018.

Then why do I currently have an American Express Platinum Card in my wallet?

Things have a funny way of coming full circle. After I signed up for an American Express Gold card, AMEX sent me an upgrade offer for the Platinum Card. While I didn’t want to pay the $695 fee, I was willing to take the card back when the bank threw in 75,000 Membership Rewards points.

Final Thoughts

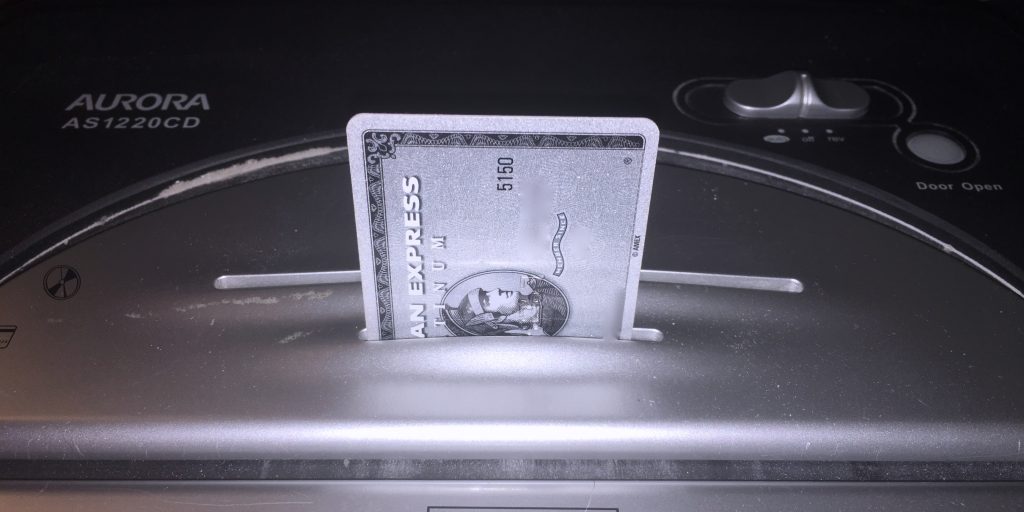

I’m not telling you to shred your Amex Platinum card (and please don’t try if you have one of the new metal Platinum cards). I’m just telling you how I determined the value I was getting from the card. I see how I can get $1,500 in value and that the card would pay for itself if I lived where there’s a Centurion Club or if I took UBER regularly. I don’t and I don’t, so it’s hard to justify paying that $695 annual fee.

I will have to make that decision again when the annual fee comes around in a few months.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

Join our mailing list to receive the latest news and updates from our team.