The Citi Prestige card. Either you think it’s one of the most valueable cards out there or you don’t understand why people love the card so much. I’d say that I’m in the first camp. I appreciate the unique perks the Prestige provides and keep the card because it’s easy for us to end up making money without much effort or having to change our travel preferences.

In October 2018, Citi announced a major revamp to the Prestige card. Several of the changes went into effect on January 4th. Since many of these changes are major improvements to the card, it has earned a permanent slot back in my wallet. Here’s a list of things that have changed already, what changes are coming down the road and what hasn’t changed.

New Bonus Point Categories

The big headline about the Citi Prestige is the increased payouts in certain bonus categories. Here are the new bonus categories:

- 5X – Restaurants

- 5X – Airfare

- 5X – Travel Agencies

- 3X – Cruise Travel

- 3X – Hotels

- 2X – Entertainment (for existing cardholders thru 8/31/19)

- 1X – Everything else

The five points per dollar for dining puts the Prestige at the top of the pack, leapfrogging the previous leaders, namely Chase Sapphire Reserve’s 3X payout and the AMEX Gold Card 4X multiplier. An additional benefit is that the Prestige pays 5X for restaurants worldwide (if they are coded correctly) while the AMEX benefit only works in the U.S. (when it works at all).

The Prestige also tops the Airfare category by matching the AMEX Platinum card’s 5X payout but improving on it. AMEX only pays 5X if you make the reservation directly from the airline. The Citi Prestige pays 5X if you book from the airline or from a travel agency, including OTA’s like Expedia and Travelocity. That can be helpful or even necessary when booking a complex ticket with multiple carriers. Another plus to booking with the Citi Prestige instead of the AMEX Platinum is the superior travel insurance coverage the Prestige provides.

For those of you who cruise, getting 3X points for cruise expenses is a huge plus. If you’re still using the Royal Caribbean credit card, here’s a great reason to switch (but hopefully you didn’t apply for that card in the first place).

The loss of the 2X Entertainment category is sad but I’ll get over it. I’ll still be using this card to book my concert and theater tickets.

$250 Travel Credit

The Citi Prestige used to have a $250 Air Travel Credit per calendar year. Unlike AMEX, the credit was good for any air travel expense, including airfare. This credit was incredibly easy to use and automatically posted to your statement. Citi has made this credit even easier to use by changing it to a Travel Credit good for any travel expense. I’ve already redeemed my credit for 2019 by charging the taxes and fees for an award ticket on Virgin Atlantic to my card.

Cell Phone Protection

Starting in May 2019, the Citi Prestige will offer Cell Phone coverage if you pay your bill with the card. We’re still waiting for the details of this coverage but since I already get this coverage with my Ink Preferred and earn 2X points, I don’t think I’ll be switching those payments to this card.

That’s the end of the positive changes, the biggest of them being the greater potential to earn plenty of Thank You points with the new multipliers. However, often when there’s pleasure, pain is following closely behind. Here’s the negative changes to the Prestige card.

Annual Fee Increase

The annual fee for the Citi Prestige is going from $450 to $495 per year. Nothing else to be said here.

Fourth Night Free Benefit Changes

This is the most controversial charge to the Prestige and the one which is causing people to reconsider if they want to keep it. While the Prestige was an above average card for earning points on spending, it was a superhero if you were able to unlock value from the Fourth Night Free Benefit.

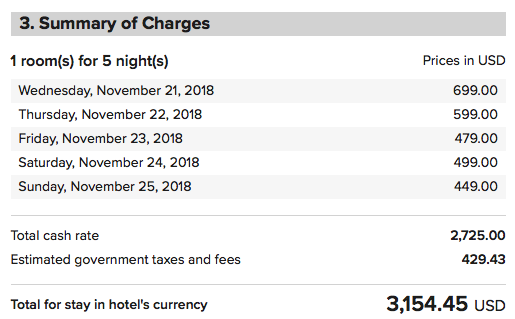

When the card was introduced, this was truly a FOURTH NIGHT free as they would reimburse you the cost of your fourth night room charge. So if you were going for an event, like say the Macy’s Thanksgiving Day Parade in New York

In this example, I’d get $499 back. But what if I made my reservation so Wednesday was my fourth night. Then I’d get $699 back. If you’re travel plans are flexible, why not show up four days before something like the Super Bowl or the Kentucky Derby and get the most expensive night free. That benefit didn’t last forever, but it did last longer than people expected it would. Now you get the “average” room cost for your stay refunded. I viewed this as a break even thing for us as we couldn’t always plan our stay to time the expensive night and I’d rather getting an average for every stay instead of occasionally getting the cheapest night for free (I did have that happen, more than once).

The new change to the benefit is undoubtedly the biggest reduction to date and probably the only way Citi could keep it instead of eliminating it all together.

Starting on September 1, 2019 – The Fourth Night Free benefit will be limited to two uses per year. For 2019, reservations booked prior to that date do not count towards the limit. So you can make two reservations between Sept – Dec 2019 and another two reservations in 2020. I’ve only been able to use the benefit twice in a year before so I’m not that upset about that. However, after that date you’ll also need to make all reservations on the Citi Thank You travel portal or call 800-THANKYOU. This will limit you to rates shown on the website. Up until now, you’ve been able to book reservations through the Citi Concierge and they were able to book any available rate on the hotel website, including member only rates and AAA discounted rates.

This is huge problem for me since rates on the Thank You website are usually higher than you’ll be able to find yourself. For an upcoming stay, the rate I found for four nights was $150 cheaper booking through the Citi Concierge than the rate I found on the Citi Thank You website.

Just to make things worse, all Fourth Night Free bookings made after September on the Thank You website need to be prepaid bookings, either with cash or Thank You points. Up until now, you could make a reservation and pay at the hotel after your stay.

I’ll be watching this one closely and see how much I’m saving with the Fourth Night Free. I have no doubt I’ll still save money, just not as much as before.

Airfare Redemptions Using Thank You Points

Up until September 2019, you could redeem Thank You points for airfare through the Thank You website at a value of 1.25 cents per point. Starting on September 1, points will only be worth 1 cent each for airfare booked through the Thank You website.

I’ve redeemed points for airfare before and after my experience with booking and then having a Southwest flight cancelled, I’m not sure using Thank You points for this was a good idea, and now it’s even less of a good idea.

I think that’s all of the negative changes, but that’s a bunch of things to unpack. As a reminder, here’s some of the benefits of the Prestige card that are not changing.

Global Entry/TSA Precheck Reimbursement

You will get either the $85 TSA Precheck or the $100 Global Entry enrollment fee reimbursed up to once every five years. If you’re eligible and haven’t done this yet, I don’t know what else we can do to convince you this is the single easiest thing you can do to make air travel easier.

Priority Pass Select Membership

The Citi Prestige provides a membership to Priority Pass giving access to lounges and credits at airport locations around the world. The Citi Prestige membership is one of the better ones available since you can bring in two guests OR your immediate family as your guests. Other cards limit you to two guests.

No Foreign Exchange Fee

You can use the Prestige around the world and not pay any foreign exchange fees. This is great since the Prestige’s 5X restaurant category is good at all restaurants, not just those in the U.S. You should never use a card that charges a foreign exchange fee if you can help it.

Elite Rental Car Status

The Citi Prestige provides elite status with National, Avis and Sixt car rental companies. Check out my experience being a Platinum Sixt member for my first rental ever with them in San Antonio.

Citi Private Pass

Citi has exclusive deals with promoters to give Citi cardholders early access to tickets for concerts. While it’s a limited number of tickets, it does open up a larger pool of tickets to pick from, even if you miss out on the exclusive Presale window. You have to pay with your citi card but I don’t mind because of another Citi Prestige benefit.

Missed Event Ticket Coverage

The Citi Prestige offers coverage for event tickets we don’t have with any other card. The reasons for making a claim are generous and we appreciate that weather or an illness are appropriate reasons to miss a show.

“If the unexpected keeps you from using tickets (such as tickets for a sporting event, concert or lecture) for an event, we may reimburse You the price of the ticket up to $500 per ticket, including service fees that are listed on the ticket or receipt.”

- The venue or producer cancels the event (or delays the event more than 12 hours) and does not reimburse or replace the ticket or provide a rain check.

- The Ticketholder can’t find the ticket, or it’s stolen or destroyed.

- The Ticketholder has an accident on the way to the event that

causes the event to be missed. - The Ticketholder or anyone living with them has an injury or illness that requires medical care.

- The Ticketholder or their family member dies.

- The Ticketholder is called to jury duty or receives a subpoena from the court, neither of which can be postponed.

- The Ticketholder is called to emergency duty as a member of the National Guard, Active Reserve or the United States Armed Forces.

- Severe weather or natural disaster prevents the Ticketholder from attending the event.

- A catastrophe causes a government authority to cutoff access to the immediate area near the event site, preventing the Ticketholder from getting to it.

We will also cover taxes and nonrefundable ticket fees (including convenience and shipping fees).

Travel Insurance Coverage

The Citi Prestige provides coverage for the following travel incidents

- Worldwide Rental Car Coverage (secondary in the U.S.)

- Medical Evacuation Coverage (up to $100,000)

- Trip Cancellation & Interruption Protection

- Trip Delay Protection

- Baggage Delay Protection

- Lost Baggage Protection

- Roadside Assistance Dispatch Service (Did you know they offered this?)

- Travel & Emergency Assistance

- Worldwide Travel Accident Insurance

For all of the coverages, except the car rental coverage and travel accident insurance, you only need to pay for a part of the bill with your Citi Prestige card to be eligible to make a claim. That’s important if you’re traveling on an award ticket and only need to pay a few dollars in taxes, some cards make you pay the entire cost of the ticket to be covered.

Final Thoughts

The main reason I kept the Citi Prestige was the Fourth Night Free benefit. If I was able to get $200 in value out of that per year, I ended up ahead. Now the card will cost $45 more per year and the value of the Fourth Night Free is going to decrease. Earning more points for spending at restaurants and airfare will be nice. Will earn that much more to make up for the negative changes, I’m not sure. I hope I never need to use the insurance coverage the card provides, but I’ll feel safer knowing I have it.

I’m going to keep the card, for now since the negative changes don’t take effect into September. I can even make bookings for into 2020 through the Citi concierge up until then if I want to. After that, I’ll have to crunch the numbers to see if I’m still making a profit having the card or if I’ll look to get rid of it. Maybe Citi will have some good retention offers for those looking to ditch the card once the changes kick in. I can always hope, can’t I?

Like this post? Please share it! We have plenty more just like it and would love if you decided to hang around and clicked the button on the top (if you’re on your computer) or the bottom (if you’re on your phone/tablet) of this page to follow our blog and get emailed notifications of when we post (it’s usually just two or three times a day). Or maybe you’d like to join our Facebook group, where we talk and ask questions about travel (including Disney parks), creative ways to earn frequent flyer miles and hotel points, how to save money on or for your trips, get access to travel articles you may not see otherwise, etc. Whether you’ve read our posts before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary