Years ago, calling your bank before a trip was essential — especially if you were heading overseas. Otherwise, your first souvenir might’ve been a frozen account and a long-distance call to the fraud department.

Today, most banks claim their systems can automatically detect travel patterns, but not all of them agree on how much notice they need. Some say travel alerts are obsolete, while others quietly recommend you still submit one — just in case.

When My Cards Froze Mid-Trip

I’d actually gotten past the stage of alerting banks every time I traveled. Sure, for a huge multi-nation trip to the other side of the globe, I made sure to let them know. But for a weekend trip to Texas, I didn’t give it a second thought.

That was, until one night at Buc-ee’s in New Braunfels, TX. We had filled up our carts with Beaver Nuggets, jerky, and more Buc-ee Beaver merchandise than you can imagine. (Note from Joe’s wife, Sharon: But I’m not obsessed. Everyone has Buc-ee’s T-shirts in a dozen different colors, right?)

I handed the cashier my Chase card. Declined. Another Chase card. Declined. Sharon’s card. Declined. Uh-oh.

My Discover card eventually went through, but this was our first night in town — and not how I wanted to start our vacation. When we got back to the hotel, it took a lengthy call to Chase’s security department to unfreeze our accounts.

Since then, I’ve made it a habit to spend a few minutes online before each trip to let the banks know about upcoming travels. Here’s what each major issuer says today about travel notices.

Here’s what the major banks say about travel notifications — and why it might still be worth taking two minutes to let them know before you hit the road.

American Express

Amex says they don’t need to know about your upcoming trips. I’ve even had them proactively write me (if I paid for a plane ticket with their card) and tell me that their system knows I have a trip coming up and to feel sure that I’ll have no problems using my AMEX card while out of town.

Here’s what they say on their website:

We use industry-leading fraud detection capabilities that help us recognize when our Card Members are traveling, so you don’t need to notify us before you travel. We recommend:

-

Keeping your contact information updated in case we need to contact you while you’re away

-

Downloading the Amex mobile app to conveniently manage your account on the go

If you have any doubt that AMEX’s systems are keeping track of you, here’s an email we received after checking into our hotel in Frankfurt.

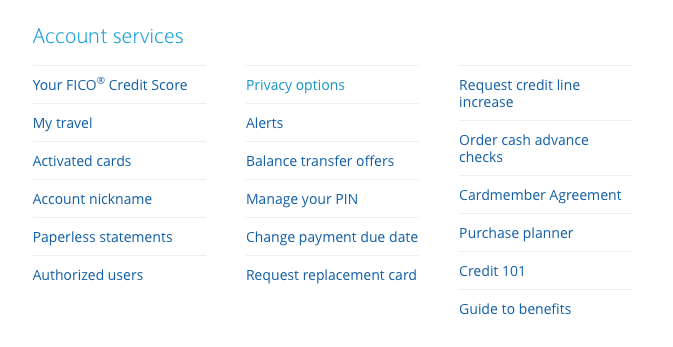

Barclays

When you log into your Barclays account, click on the Services tab. From there, click on My Travel:

This will take you to a page where you can inform Barclays of your travel plans and dates.

Chase

After my previous problems with Chase, I always notified them when we’d travel at the Chase Travel Notification website. However, they now say notifying them is no longer necessary.

Is it required to set a travel notice with Chase before I travel?

No, Chase no longer accepts travel notices. With advancements in fraud detection technology, there’s no need to call before traveling. If necessary, Chase may reach out to you directly to confirm a purchase. You can also customize account alerts to get notified and informed of account activity at chase.com or in the Chase Mobile® app.

Citi

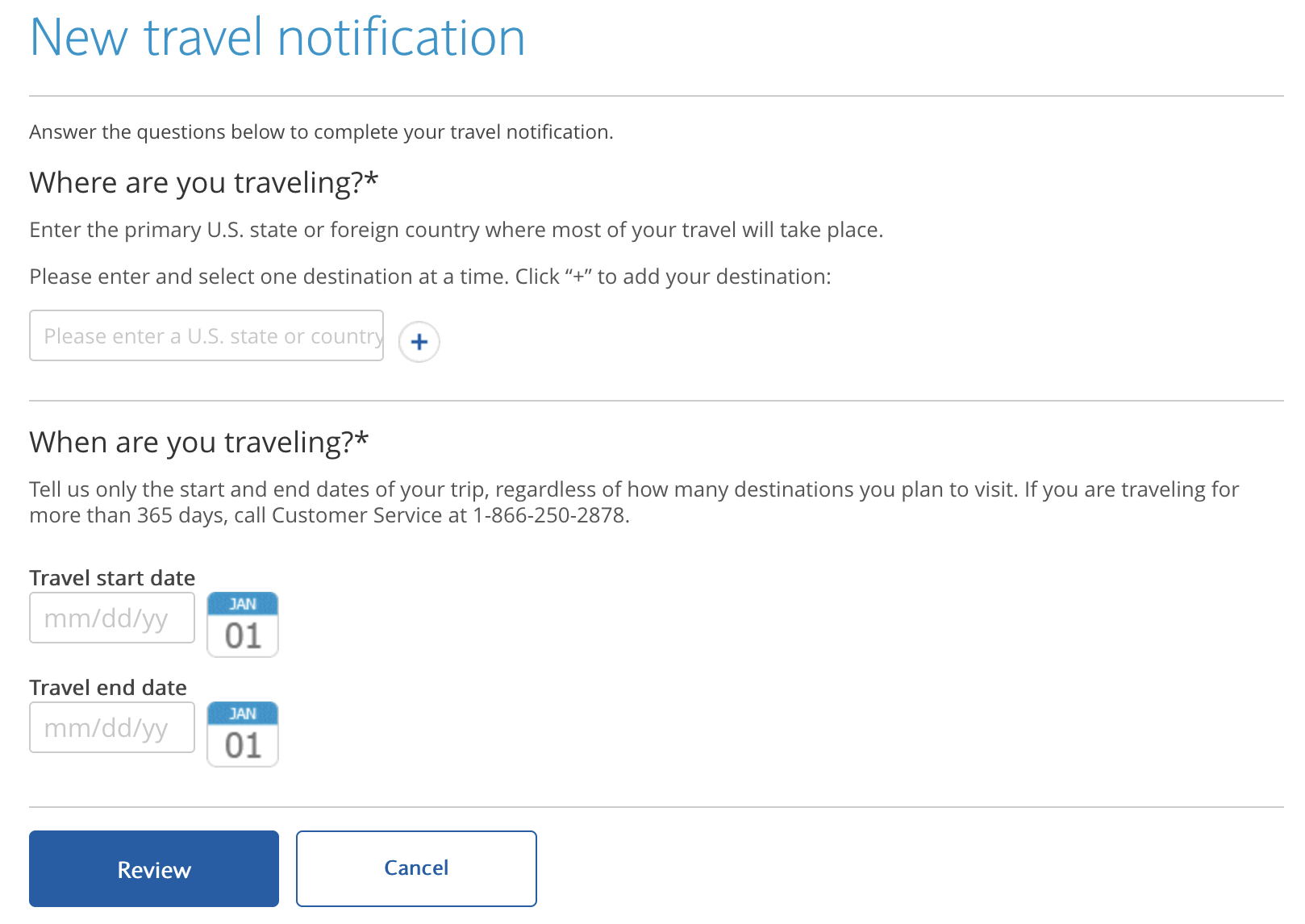

I couldn’t find a direct link to the travel notice page on the Citi website. However, when I typed “Vacation Travel Notice” in the search box, it directed me to the Travel Notice page.

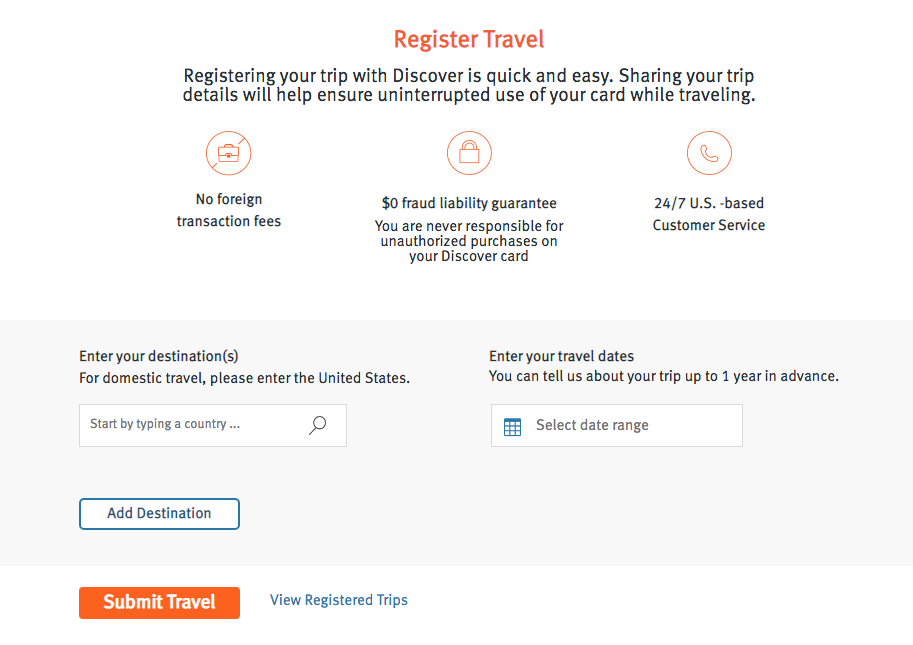

Discover

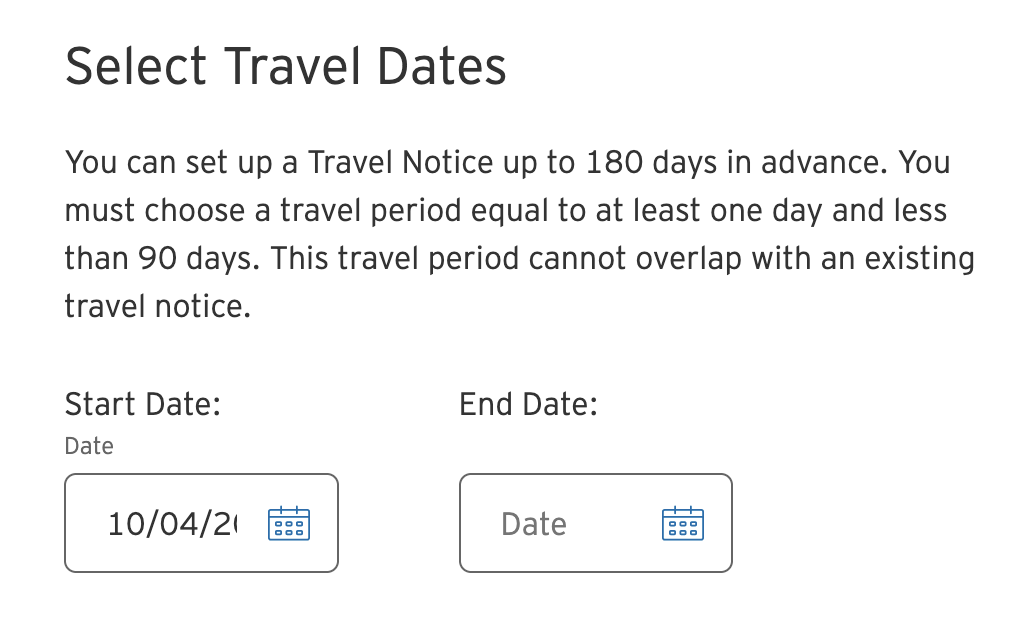

To alert Discover about your upcoming trip, you need to log into your account and click on the “Register Travel” link under the “Security” tab.

That will take you to the page where you can enter your trip details.

Other Banks

Most other banks have links on their web pages with instructions on how to put a travel notification onto your account. Bank of America and US Bank let you enter the information on their websites or through their mobile apps.

Like American Express and Chase, Capital One and Wells Fargo don’t have a place on their websites to enter a travel notice, but instead tell you that it’s no longer necessary to do so.

Final Thoughts

Even though most banks say you no longer need to set a travel notice, real-world experience shows that things can still go wrong. I’ve had my cards declined on a domestic trip, and I’ve heard similar stories from travelers who found themselves stuck when their bank’s fraud system got a little too protective.

One of our guides on an Adventures by Disney trip told us that while she was overseas, her account was locked — and the bank required her to visit a branch to resolve the issue. Unfortunately, the nearest one was about 7,000 miles away.

That’s why, even with better fraud detection, I still take a minute to check each card before traveling. Make sure your contact information is up to date, enable mobile alerts, and download your bank’s app so you can approve charges or unlock your account instantly if needed. It’s quick, easy, and can save you a lot of frustration while you’re supposed to be relaxing.

Because let’s be honest — no one wants to start their vacation with a declined card and a call to the fraud department.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

6 comments

Citi spies on me. I bought an airplane ticket using one of my Citi cards. I just got an email from them telling me that they know I am traveling soon.

I lost my wallet in Toronto on my way to Copenhagen. Both my husband and I have the same card so he still had his. Called Chase to let them know and to cancel the remaining card. Chase said don’t worry about it, we know you need the other card and you won’t be responsible for any fraudulent charges. That was weird but helpful. Got the wallet and credit cards back three weeks later and no unauthorized transactions.

Interesting Chase shut you down in Texas. I’ve traveled extensively in the US for over 35 years and never had a card rejected (even in Alaska and Hawaii which aren’t continental US and may be treated differently by banks). Also would be interesting to know when you experience with Chase occurred since now my understanding is they would typically text you (if you have alerts set) to ask if the transaction is valid. Reply “yes” and no problem.

That being said I ALWAYS let them know of my foreign travels. Even when the Amex Platinum rep says that isn’t necessary I still feel better having it in my profile. Only time I got rejected was trying to buy something at a store in St Thomas on a cruise (years ago when I didn’t think to let them know about cruises) but luckily I had another card that was accepted. No point having an issue overseas and calling (or going online to notify them of upcoming international travel) is, IMHO, simply prudent.

I’m in Warsaw, Poland right now.

A week before I left to come here, I called CapitalOne to tell them where I would be AND the dates when I would be here. 15-20 minutes on the phone with their Customer Service.

Two days after my arrival I tried to log in, and guess what. I was frozen out of my accounts.

I don’t have an international phone so when this happens I rely on an e-mail verification.

Guess what? They don’t have an e-mail verification option.

They have 2 USA 800 numbers to call. Totally useless.

What’s in your wallet ????

Like AA Flyer I have traveled extensively for 40 years including hitting every state and 5 continents. I have never notified a credit card company about travel in the US or Canada. However, I always call Amex and Chase when I’m traveling to Europe, Asia, South America or Australia/New Zealand. Even though the agent says I don’t need to let them know I make sure there is a record on my file (and have never had a card turned down internationally). One of the reasons I don’t bother to notify them for domestic or Canada travel is that I can easily swap out cards (I travel with a variety of card across multiple providers) and also could always use my debit card or go by a Bank of America branch (in the US) as a last resort. Also, I have no problem calling or responding to a text to clear up any questions that may arise. Internationally, however, I travel with only cards I plan to use as also, even though I can call to resolve an issue, the time zone differences make it more difficult.

BTW @James – get the $10 a day international dialing plan almost all cell providers offer. It is well worth it IMHO to keep contacts back home, access texts/websites and make calls if needed. Sure you can swap the SIM card (pain and lose some data on your phone) or use a VOIP calling app but for $10 a day I prefer not to have any complications.

I received a fraud alert on my Chase Sapphire Reserve card while traveling domestically last month (September). They suspected that a small ($7.17) online charge was fraud and I texted back that it was not me. They said they’d cancel my card and mail a new one. I called to explain I was traveling and while I could use another card I preferred to use the CSR. The rep told me something I was not aware of: they could freeze my card for online use but allow any “physical card” use while I was traveling. I asked them to restrict even physical use to three states I would travel in and they did that.