Signing up for credit cards and getting the sign-up bonuses is one of the easiest ways to earn a nice stack of points and miles with very little effort. As long as you have good credit and can pay off your bills in full, this is a great place to start. You’ll soon see that besides all of the personal credit cards available, there are almost as many business credit cards out there. You’ll have twice as many bonuses to choose from. That is, if you have a business.

There’s no shortage of websites that tell you the many ways you can have a business. It all sounds so easy and apparently, everyone has a business and can apply for a business credit card. Here are some ofexamples I’ve seen:

- Do you sell anything?

- Do you provide any services you get paid for?

- Do you rent a property?

- Do you have a side job?

- Do you run a lemonade stand?

- Do you sell brownies at the local market?

Congratulations, you’re a business. Now go and sign up for a business card with this referral link!!!

Sometimes it might be that easy. However, other times it’s not. When we started Your Mileage May Vary, I had to prove to Chase that it was a real business. Turns out, it’s not as easy as it sounds.

Sharon’s had a business card from Chase for years. For her, it was easy because she was a contract employee and received a 1099 form for her income.

For me, it wasn’t as easy. Several years ago, I tried to get a business card from Chase for a previous endeavor. I was just starting out and had nothing to prove I was real, aside from an unfinished website. However, I had expenses and wanted to keep them separate, so I applied for a business card. Chase’s response at the time was “Come back when you have something real you can show us.” Ouch.

I blew Chase off after that. If they didn’t want my business, I didn’t want to give business to them. Now I had a business with expenses and income that I can prove.

I dusted myself off, hitched up my pants and pulled up the Chase website to apply for the Chase Ink Preferred business credit card.

There are plenty of websites to guide you through the process of how to apply for a business credit card. I used this one from One Mile at a Time, as it was specific to Chase. I saw in the article where it said you “can” use your name as the business name, but I chose to apply with the actual name of the business. That probably caused my headache of getting approved.

I was hoping for instant approval, but that didn’t happen. Instead, I was told that I would hear from them via mail in the next 30 days.

The first round of waiting begins

There was nothing I could do at this point but wait. While searching, I even found a diagram that tells you (supposedly) what each message from Chase means and what you should do next (it might be out of date but shows how confusing the approval process can be). Instead of going that route, I just waited for the mail to arrive, hoping it would be a card and not a denial.

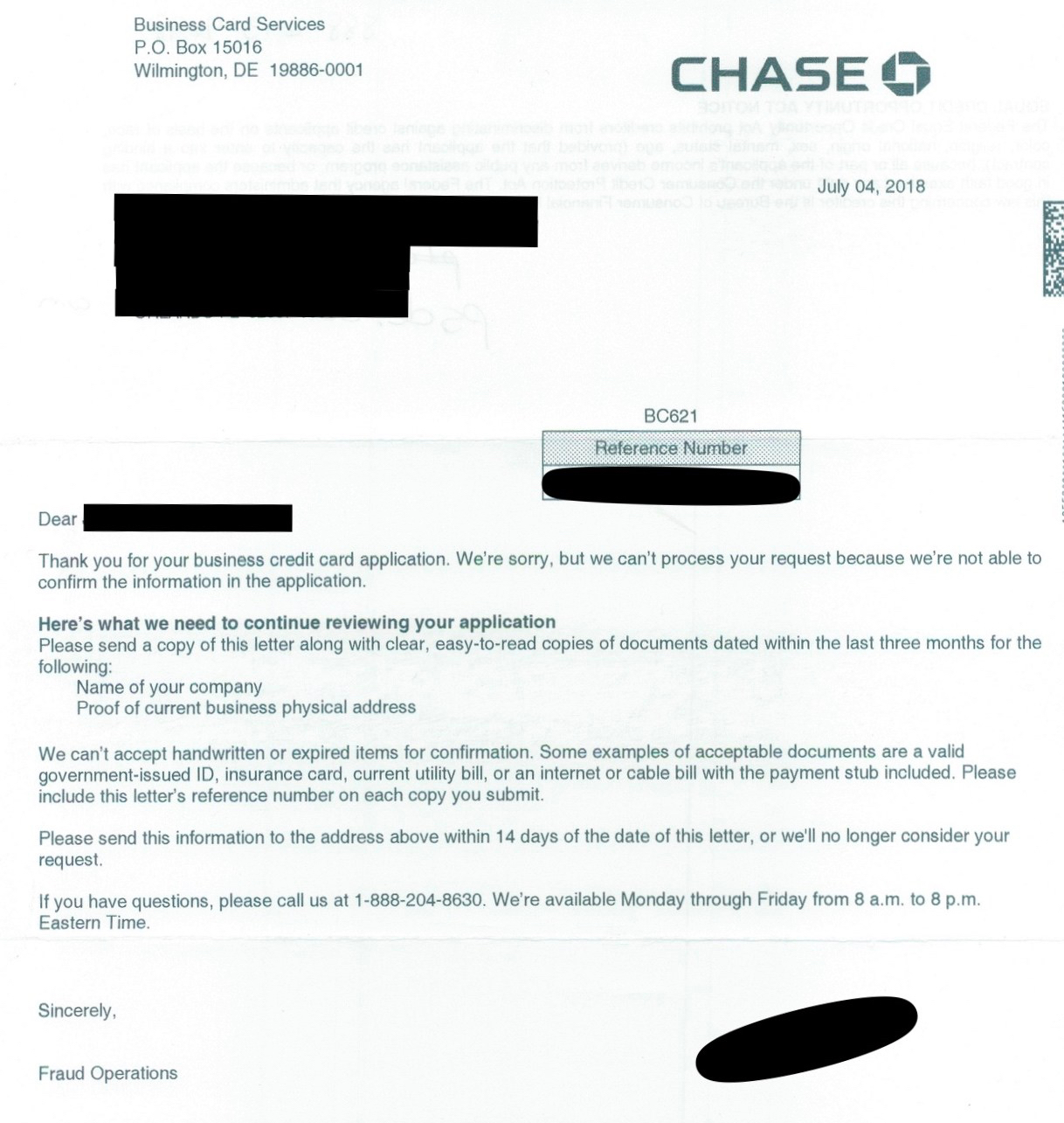

What I received was neither of those two.

Chase wanted me to prove the business was real. I took the next step and called them.

Calling Chase

I’ve heard horror stories about people being interrogated by Chase Small Business phone reps about their businesses. Requests for business plans, budgeted future expenditures, and forecasted expenses were all things that have been asked for. I hoped that wasn’t the case. However, I didn’t have anything they wanted like government ID, insurance or utility bills. Since Sharon and I are the only “employees,” all the expenses and bills are in our names. I figured all they could do at this point was say no. I was invested so I might as well keep going.

I called the number on the letter and talked with a representative. I explained that I knew what they were asking for but I didn’t have that type of document and gave the reasons why. She then said, in a rather condescending tone, “In that case, the only other thing we can accept is a Tax ID number and a Fictitious Name Registration letter.” I replied “Great, how can I send them to you.” She told me that I could bring the documents to a local Chase branch Small Business desk and they’d attach it to the application. I told her that I’d bring the documents as soon as I could.

Getting the Documentation

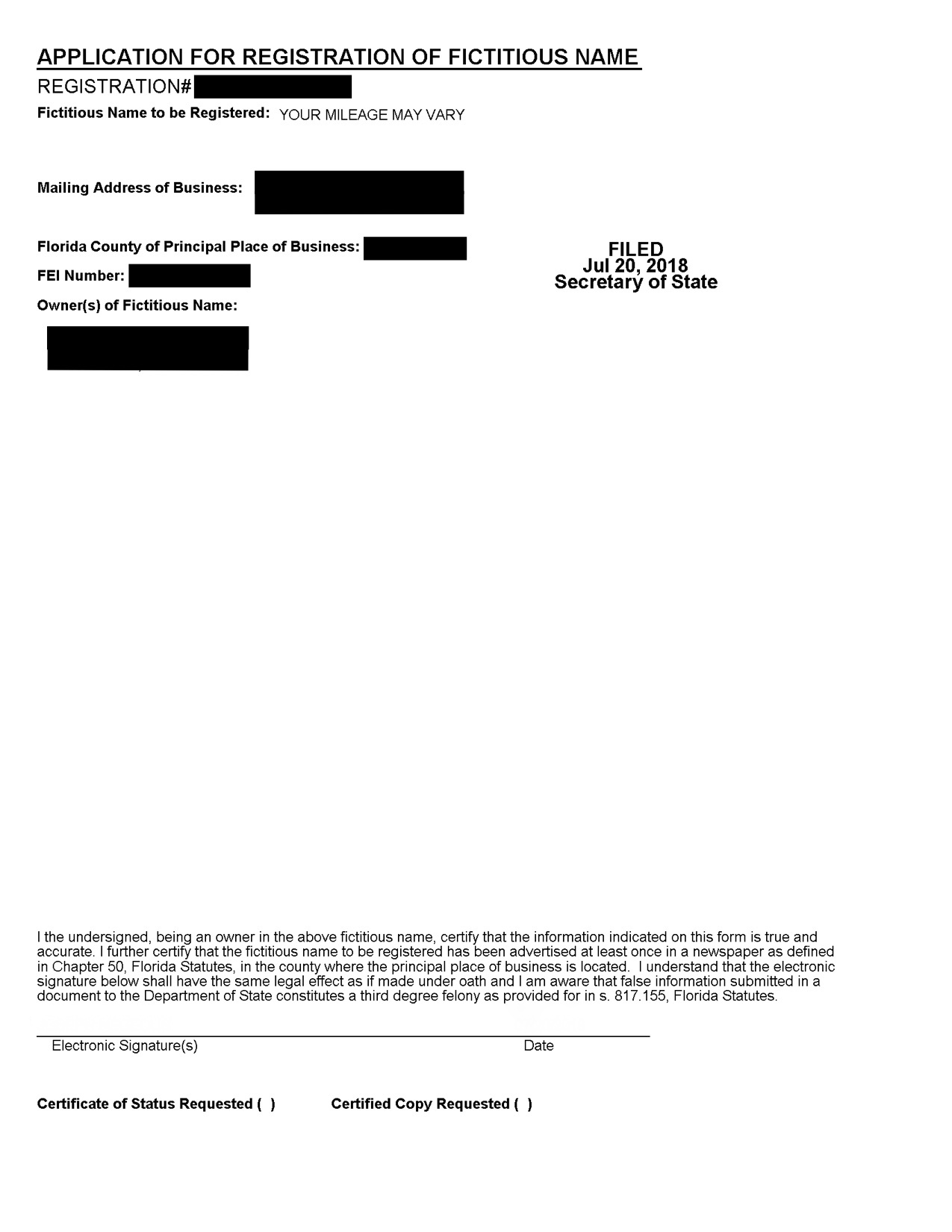

I have a Tax ID number from a previous business. Per the IRS website, when starting a new business as a sole proprietor, you do not need to get a new Tax ID, so that requirement was complete. The Fictitious Name paperwork was a different story. I’d never gotten around to filing one with the state for Your Mileage May Vary. This was a perfect time to get off my backside and become official.

To file for a Fictitious Name Registration in Florida, you need to go to this website: https://efile.sunbiz.org/ficregintro.html

Filing the form costs $50 and the registration is good for five years.

Getting the Documents to Chase

Now that I had the documents that Chase requested, I headed to my local branch. After signing in and waiting to be helped by the business account associate, I explained the only reason I was there was to provide documentation for my application. She looked up my case number and headed to the back with my papers. About 10 minutes later, she came back. I was all set. All told, I was there for about 30 minutes.

The second round of waiting begins

All I could do again was wait. After a few days, I got antsy and called the number from the letter to see if they had any more questions. The rep looked up my case and told me that they had no record of the paperwork I brought to the branch.

Me: I took the paperwork four days ago

Rep: You see, there’s a system where the branches can scan the paperwork directly to your file

Me: So why don’t you see it?

Rep: Well some branches don’t use that system and fax the paperwork instead. We get thousands of faxes a day so it can take a week or two before it gets sorted to your case

Me: What can I do to expedite this?

Rep: Bring the papers back to the branch and tell them to scan them and not to fax them.

Me: I’m not available when the branch is open for several more days. Is there any way I can send the papers to you?

Rep: You can fax them to us.

Me: I thought you said it can take weeks to sort the faxes.

Rep: Yes

Me: I don’t have access to a fax machine

Rep: Can you email them to us?

Me: Of course I can.

Rep: OK, here’s the email. But be aware that it still can take several days to a week for us to review the documents.

Really. Really? After all of this back and forth, I could have just scanned and emailed the supporting documents. I asked for the correct email and thanked him for his time. I immediately scanned and sent the documents to Chase.

The Third Round of Waiting

This time I wasn’t waiting around. I called the Chase automated application line at 888-338-2586 to check on my card status. For the first couple of days, I received the same message that my application was under review and to wait for a letter.

Then one day I received a different message, Your application has been approved. It took about a week longer before I received the envelope in the mail.

I haven’t been so excited to get a card in a long time. It wasn’t even made of metal.

It’s not a fancy card but there are some categories I can use it for like cell phone and internet services. Online advertising is also a bonus category, which is helpful to get the word out about how great Your Mileage May Vary is. The card does have amazing coverage for cell phones as long as you pay for your bill with the card.

Final Thoughts

I did really want this card. I wanted to see if I could prove to Chase that I was a real business. I also wanted to prove to them that they were wrong for not giving me a card the first time. The other reason I went through all of this was to see what the process was like. Hopefully, after reading this you’ll know that it is possible to go through the steps and provide the paperwork that the banks require if you’re running a legitimate business. I also did this to warn those who listen to websites that say “Everything is a business.” While that may be true, it just might not be a business that a bank is willing to lend money to.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

3 comments

I was given the run around by Chase for a business CC, so I gave up. Other people I know had the same experiences with Chase. Now I am over 5/24 and I don’t even care any more. I have banked with Chase for over 45 years. As a bank, they suck! I was going to open a “Private Client”, as I just retired. Their investment advisor wanted me to put 2/3 of my funds into an annuity. I walked out of the meeting and told them no way you are getting money! I do all my investing by myself and I am doing just fine. Chase is a very greedy bank. That is why they are so profitable. Chase’s marketing program “It’s all about relationships” is long gone! Chase only cares about profits.

The last 3 Chase Biz applications my spouse and I applied for have all been approved within a day, including the CIP just last week. Applied as a sole proprietor, 1 employee, 0 years, and little to no income– essentially applying as a new business just starting out so there’s nothing to verify. Granted, they could have easily been denied as well but if you have a good credit score, I think it’s one strategy for approvals…

This does not match my experience at all. Not sure what their algorithm is, but my spouse and I have found it very easy to get Chase business cards without a whole lot of actual income from said businesses. Nor do we set up separate tax IDs.