One of the unfortunate truths when using credit cards to earn points and miles is that you’re going to eventually have to deal with the banks to sort out a problem. It doesn’t matter if it’s an issue of your account getting hacked, trying to get a retention offer for a card or if they’re asking for more information before approving your application, it means having to talk with one of their representatives. For me, that also means I have to decide if the problem I’m trying to resolve is worth having Sharon get on the phone with a bank (Note from Sharon: I’m really not a telephone person. Even less so when it’s a “professional” call)

I’ve had problems before, like I wrote about here and here, but this was the first time I’ve ever had to deal with a bank about my corporate card.

This situation happened during my two-week work assignment in New York. I was staying at the Hampton Inn near JFK with the rest of our team. The Hilton JFK hotel is right next door and has a restaurant and bar that’s open late. Perfect place to get together to review that day’s work and plan for tomorrow.

One nice thing about eating at a hotel restaurant is the staff has no problem with eight different checks. So imagine what happens when the cards for seven of those checks go through without a problem and one of them is rejected for possible fraud.

Now, this is an establishment in a hotel. The charge goes through as “Hilton JFK.” It’s also somewhere we’ve all been eating at for the last week and no one’s had a problem.

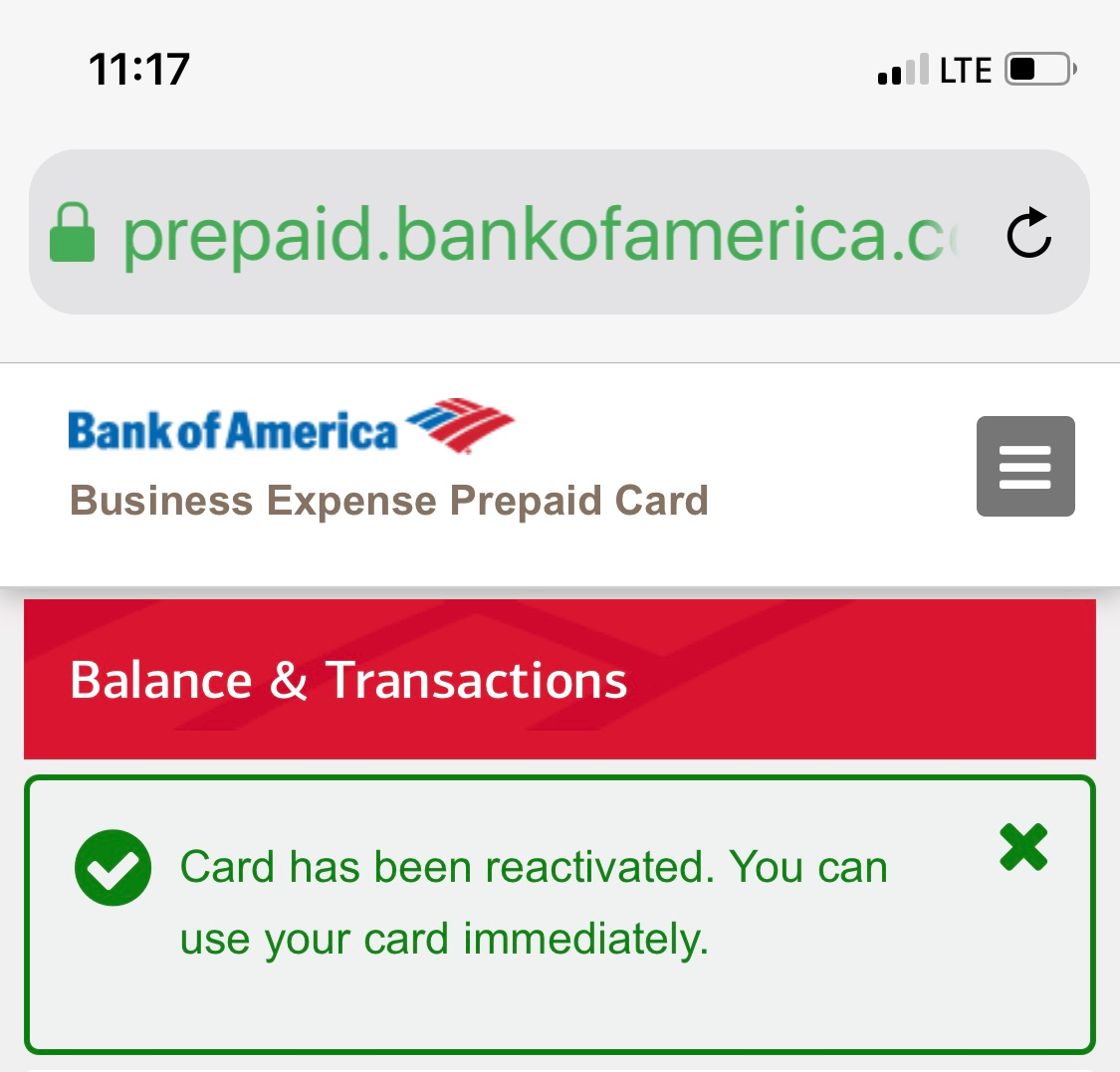

Our cards were issued by Bank of America and they have an app that’s solely for managing your corporate pre-paid card. Logging into the app showed a charge denied for possible fraud and that the card has been deactivated. Going to the website and clicking through several screens eventually lets you say that this charge was actually you.

So what happens when you have them run the card again after you just reactivated it? It rejects again.

This same situation played out for four different members of my team over our two weeks. None of them happened on the same day and we were all using our cards at the same location for the entire trip. Why Bank of America’s computers decided that using a corporate card at a hotel restaurant would be suspicious is a mystery to me. Why they were unable to unlock the card and enable it to be used after confirming the charge is even more baffling.

In all, it just leads me to back to the same question.

Why do banks make things so difficult?

There’s nothing we can do as consumers to combat this problem. I guess we could stop dealing with a bank if they cause too many problems but that wasn’t even a choice in this instance as the card wasn’t mine.

I’m more in the camp of dealing with these problems is necessary if I want to use credit cards to earn points and miles. I could avoid most of these issues if I only had one card and didn’t care about the points but that’s not something I’m going to do.

Like this post? Please share it! We have plenty more just like it and would love if you decided to hang around and clicked the button on the top (if you’re on your computer) or the bottom (if you’re on your phone/tablet) of this page to follow our blog and get emailed notifications of when we post (it’s usually about 3 or 4 times a day). Or maybe you’d like to join our Facebook group, where we talk and ask questions about travel (including Disney parks), creative ways to earn frequent flyer miles and hotel points, how to save money on or for your trips, get access to travel articles you may not see otherwise, etc. Whether you’ve read our posts before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

4 comments

This is the first time I’ve heard of a corporate prepaid card. Why not use a regular corporate postpaid card? I realize that it’s almost certainly not up to you personally, but it doesn’t seem to be the norm and also would presumably tie up large amounts of cash that could be used elsewhere in the interim.

I’m sure there’s a reason for it. Since I’m only going away for 1 week, once or twice a year, there’s no reason for me to have a corp card they’d need to monitor. This way I can keep the card and they just load money onto it shortly before my assignments. When I’ve reconciled my receipts, they drain the remainder in the account.

You know what’s more infuriating? Trying to pay my Cap1 bills from their app/online system. Their system refuses to allow me to pull from my two banks. Called multiple times to try and get this glitch fixed over the course of two years. They say they’ll investigate and fix the problem, but of course just ends up in a black hole and never get a reply or let alone a resolution. And they want my business? Get outta here!

Elizabeth Warren is the only one with the balls to take on these abusive/incompetent financial institutions.

FWIW, from my own experience managing a corporate travel and purchasing card program, I would suggest that you check with the administrator of your companies program. Why? Companies can choose to include/exclude merchant categories where they will/will not allow a transaction.

In this case, it could be that your company allows charges coming from the hotel classification and not a restaurant classification. On the other hand, if you have been using that card at other restaurants outside of a hotel – it could be that the restaurant in question does not have their merchant classification set-up correctly – hence the denial.

This happens on a not too frequent basis – but it does happen.

I would ask BofA – if they will tell you, or your administrator to review the charge in question and find out what merchant SIC code/category the charge is coming in at. It could be the charge is coming in under a merchant code – not tied to a restaurant.

I’m sure this is all very frustrating.

SO_CAL_RETAIL_SLUT