I’ve slowed down with credit card applications since the coronavirus lockdown. One reason for this was because we didn’t have any need to replenish our accounts since we weren’t making any travel plans. In fact, our account balances were going up from redeposited points of the reservations we had to cancel.

Eventually, I decided that this pause would be a good time to get some of the cards that I always wanted but never got because there was always a better offer. During the worst times of 2020, there were no other good offers, so I applied for cards with moderate sign-up bonuses and low minimum spending requirements.

Now that times are different, I just applied for our first mega-bonus card of the pandemic and got an automatic approval. Even with the banks cracking down on applications due to the financial downturn, we’re three for three with instant approvals.

The first card we applied for was the Fidelity Rewards Visa.

This is a straight 2% cashback card. The sign-up bonus was $150 after spending $1,500 within 90 days of account opening. The application was instantly approved and we met with spending requirements within two statements. The $150 is already sitting in my Fidelity account.

Since Sharon was under 5/24, we decided the best choice was to get a Chase card we wanted. All it took was for the Freedom Unlimited to add 5x earning for the first year at supermarkets and 3x for dining and drugstores for us to sign up.

The sign-up bonus for this card is $200 (or 20,000 Ultimate Rewards points) when spending $500 within three months of your approval date. Sharon received an automatic approval for this card.

Given that our timeline wasn’t the best since I applied the night before Chase announced the new Freedom Flex card. I haven’t lost any sleep about it because if I had a choice, I’d take 1.5X on all spending instead of 5x for rotating categories. I plan to put this card at the top of Sharon’s wallet and she doesn’t do category spend. 🙂

Since we’re close to meeting the spending for these two cards, it was time for another application. I had one card in mind and I even had to do some shuffling to make it happen.

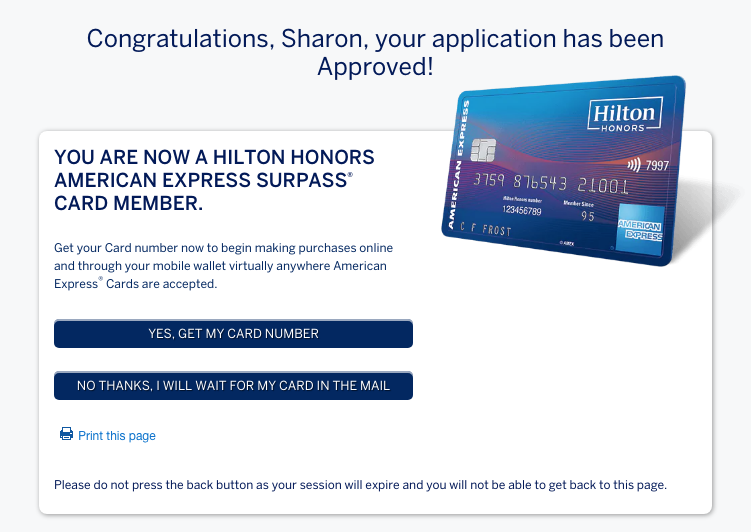

Our most recent application was for the Hilton Surpass AMEX card.

Back in July, we got a mailer offering 175,000 Hilton Honors points for the Surpass AMEX. That’s the best offer I’ve ever seen for this card and while we’re not looking to stock up on hotel/airline points, this was too good of an offer to pass up.

Sharon received an instant approval for the card when using the sign-up code from the mailer.

The spending requirement is $4,000 in three months, which at the peak of the pandemic was more than we were spending. Now that we’re leaving the house on a semi-regular basis and even going on the occasional trip, this is a reasonable amount for us to spend in three months when added to our everyday expenses.

Under usual circumstances, the Hilton Surpass AMEX is a great value because it provides automatic Hilton Gold status for the $95 annual fee. In my opinion, this is the sweet spot for Hilton status. Sharon’s status updated from Blue to Gold within an hour of her approval from AMEX.

Final Thoughts

There’s been much written about banks cracking down on approvals due to the economic downturn caused by the coronavirus. It might be because we’ve taken a strategy to play it slow with applications, but we were able to go three for three with instant approvals during the pandemic. Given, we weren’t trying to get cards with huge sign-up bonuses from high spending requirements. Nevertheless, we picked up two no-annual-fee cards that earn a solid return on everyday spending and one card with a never-seen-before sign-up bonus which provides excellent benefits for the yearly fee.

While 2020 has been a wipeout in many respects, I’m currently satisfied with our credit card applications so far.

#stayhealthy #staysafe #washyourhands #wearamask

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and get emailed notifications of when we post. Or maybe you’d like to join our Facebook group – we have 15,000+ members and we talk and ask questions about travel (including Disney parks), creative ways to earn frequent flyer miles and hotel points, how to save money on or for your trips, get access to travel articles you may not see otherwise, etc. Whether you’ve read our posts before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

Image by TheDigitalWay from Pixabay