A bank’s number one job is to make money. While they spend a lot of time and effort to obtain new customers through advertisements and, more importantly for us, sign-up bonuses, they also constantly try to wring more cash out of their existing clients.

They accomplish this by convincing cardholders of no-annual-fee or low fee cards to upgrade their account to a premium card in the same family. Sharon just received one of these offers for a card and I’ll show why, in this case, it’s a horrible offer.

Upgrade IHG Rewards Club Select to IHG Rewards Club Premier

Chase is offering an upgrade from the Select to the Premier card and will pay her 5,000 IHG Rewards Club points after making a single purchase with the new card. If you value IHG points at a max value of 1 cent each, this is a $50 value.

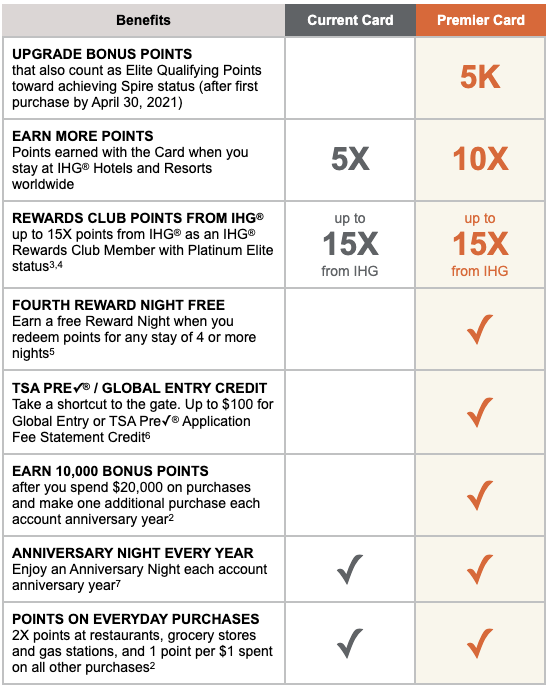

Chase also shows all the differences between the cards.

The IHG Premier does earn more points when staying at IHG hotels, has a fourth night free on award stay benefit and a $100 credit for TSA Precheck or Global Entry. It also gives you 10,000 bonus points if you spend $20,000 on the card + 1 purchase in the account anniversary year (please don’t put $20,000 of spending on this card).

Why is this such a bad offer?

The card Sharon currently has is the discontinued IHG Select card. There can be advantages of keeping discontinued cards. Here’s what’s better about having the IHG Select card:

- Lower annual fee – The IHG Select has a $49 annual fee while the Premier card annual fee is $89.

- IHG Select provides a 10% rebate on redeemed points, regardless of the length of stay.

The cards also have several perks that overlap:

- IHG Rewards Club Platinum status

- Yearly free night certificate at hotels with award nights of 40,000 points or less

There are also some downsides to upgrading. If you upgrade, you miss out on the IHG Premier card’s sign-up bonus, which currently is 125,000 points. Since there’s also a difference in the annual fee, you’ll be assigned a new anniversary date. While this may seem trivial, it makes a huge difference regarding your anniversary free night certificate.

With the IHG® Rewards Club Premier Credit Card, you’ll have a new annual fee of $89. Please note that upgrading will also change the timing of your Anniversary Night, which will now be available for redemption on the anniversary of your account upgrade date each year.

So if you’re six months into your year with the IHG Select, you’ll have to wait another 12 months before you’ll earn another free night.

There are reasons you’d want to keep the IHG Select and others why you might want to upgrade to the Premier.

Why Not Both?

With the IHG Rewards Club co-brand cards from Chase, there’s an interesting possibility when it comes to double-dipping. If you’re currently an IHG Select cardholder, you can apply for the Premier card and earn the sign-up bonus while keeping your current card. Chase says so on its website.

If you currently have an IHG Rewards Club Credit Card from Chase, or you earned a new cardmember bonus on that credit card within the last 24 months, you are not eligible to receive another of the same credit card.

The only thing you’re not allowed to do is get two of the same card or apply for a card that you’ve received a sign-up bonus for in the last 24 months.

The best part of having both cards is that the benefits will overlap. For example, if you’re booking a 4-night award stay, you’ll get the fourth-night free AND get a 10% rebate on the points you pay. You’ll also get a free night certificate from each card.

But There’s One Reason You’d Upgrade

I can think of one reason why you’d choose to upgrade your card. Chase’s 5/24 rule applies to the IHG Rewards Club Premier card, so some people will not be able to apply. If you think that you’ll get more from the fourth-night free benefit than the 10% rebate on award stays worth paying the additional $40 annual-fee, upgrading might be your only choice.

Final Thoughts

If you’ve held on to the IHG Rewards Club Select card until now, you’re familiar with the benefits. However, the Premier card does have some worthwhile perks and provides a free night when paying the $89 annual fee. If you’re an IHG fan, like we are, then it’s a much better choice to hold both cards, if you can, than to take the upgrade offer.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

#stayhealthy #staysafe #washyourhands #wearamask #getyourCOVIDvaccine

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and get emailed notifications of when we post. Or maybe you’d like to join our Facebook group – we have 19,000+ members and we talk and ask questions about travel (including Disney parks), creative ways to earn frequent flyer miles and hotel points, how to save money on or for your trips, get access to travel articles you may not see otherwise, etc. Whether you’ve read our posts before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

2 comments

How do you get the benefits of both cards on the same stay?

Whichever card you use, those are the benefits (either the 4th night free with Premier OR the 10% rebate with Select).

Do you pay for the stay splitting the charge with half to each card to meet the $30/night minimum spend?

You get the benefits just from having the credit cards linked to your IHG account. You don’t need to use them for your stay. When booking a 4-night stay, you’re only charged for the first 3 nights. After the stay, 10% of paid points show up as a credit to your account. The $30 refers to qualifying stays for promotions, not award redemptions.