If I had to name the one skill that determines whether points & miles becomes a fun long-term hobby—or a short, expensive lesson—it wouldn’t be optimization.

It wouldn’t be award charts. It wouldn’t even be knowing which card has the best multiplier.

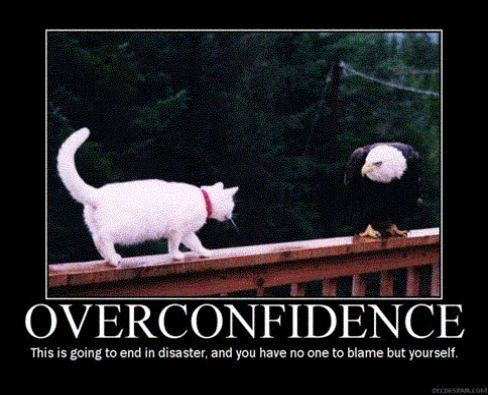

Earning points and miles seems easy, right? A few hacks, a few swipes, and you’re rolling in rewards. But here’s the harsh truth: without common sense, your “easy wins” can land you in big trouble.

I’ve seen enthusiastic beginners pull off risky stunts, only to act shocked when things go south. Navigating the points-and-miles world takes more than knowing the latest trick. It takes patience, knowledge, and—above all—common sense.

Some People Just Don’t Get It

I don’t want to sound like a prude, but I shake my head every time I see posts like this online:

“I just signed up for a card and met the $10,000 spending requirement in 8 days by buying money orders and gift cards. When can I cancel the card and what do I do with these gift cards?”

Or worse:

“I cycled $50,000 through my card with a $5,000 limit by cashing in gift cards for money orders in one month. Chase just shut down my account. WHY??? Who can I complain to?”

Really? What are you thinking? Did anything about this seem normal—especially when you’ve had the card for less than a week?

Banks notice this stuff. They have algorithms, risk teams, and yes, actual humans reviewing accounts. What do you think they’ll do when you “game” the system in ways that scream suspicious activity?

Why Common Sense Is Essential

This isn’t Monopoly money. It’s real money with real consequences.

If your credit score is just a tool for racking up rewards, that’s a short-sighted approach. Your credit history affects major life decisions, like:

- Getting approved for a mortgage or car loan

- Renting an apartment

- Insurance rates (in some cases)

- Even landing certain jobs (depending on the employer and position)

Imagine you maxed out 20 cards, canceled half of them within a few months, and left your credit profile looking like a mess. That’s going to hurt.

And to be clear, closing a card isn’t automatically “bad.” But opening (and closing) a bunch of accounts quickly, spiking your utilization, and making your file look chaotic can raise red flags—and that can matter long after the points are spent.

Forget about how you look to banks—because, honestly, if you keep pushing the envelope, they will catch up to you. Whether it’s AMEX’s anti-abuse reviews or stricter rules from issuers like Chase and Citi, risky behavior tends to backfire sooner or later.

You might be thinking, “Who cares? There are plenty of cards out there. I’ll move on to the next thing.” But trust me, banks and credit card companies are smarter than you think.

The Right Way to Approach Points & Miles

I don’t think there’s a single “right” way to earn points and miles. Everyone’s journey is different, and that’s one of the main reasons we started Your Mileage May Vary. What works for one person might not work for another.

That said, being financially irresponsible isn’t the right approach for anyone.

If you’re new to the game, here’s how to keep it smart and safe:

- Start Slow: Don’t dive in headfirst. Learn the ropes and understand how the system works before you try advanced strategies.

- Stick to What You Know: If you’re a Marriott fan, maximize Marriott rewards before branching out. It’s better to master one program than dabble in ten.

- Avoid Small Balances Everywhere: Having 5,000 points in ten programs won’t get you far. Choose a few programs and stick to them.

- Never Risk Your Financial Security: Take a step back if you can’t pay off your cards in full or struggle with financial discipline. There’s a big difference between having $500,000 in credit available and using it responsibly.

Manufactured Spending: A Word of Caution

This isn’t a post about manufactured spending (MS)—I’ve already shared my thoughts on that topic here.

But here’s the bottom line: MS is like wizardry. Done right, it can be incredibly rewarding. Done wrong, it can blow up in your face.

Start with the basics before you try the advanced stuff. Or, as Hermione Granger would put it…

Final Thoughts

Whether you’re new to this hobby or a seasoned pro, the key to long-term success is using common sense. Sure, there are flashy tricks and advanced techniques, but they’re not worth it if they jeopardize your financial stability—or get you shut down.

Do you have questions about starting your points journey? Or maybe a tip that’s worked for you? Drop a comment below—I’d love to hear your thoughts!

Want to Stay in the Know?

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

Feature photo from Frits Ahlefeldt