One of the most aggravating parts about collecting travel loyalty points is the existence of targeted offers. Before the internet, you had no idea if someone got a better offer than you. It was a simpler time back then. However, we’re in a world of instant communication where, if there’s a better offer for a credit card or a flash sale for flights, the word will get out within minutes and disseminate to all corners of the blogosphere within hours. But with targeted offers, there’s no guarantee that you’ll be able to book that cheap flight or save money with an AMEX offer. You have to hope you’re lucky enough to be picked and there’s a bit of frustration if you’re not.

One type of targeted offer tries to get you to change your habits.

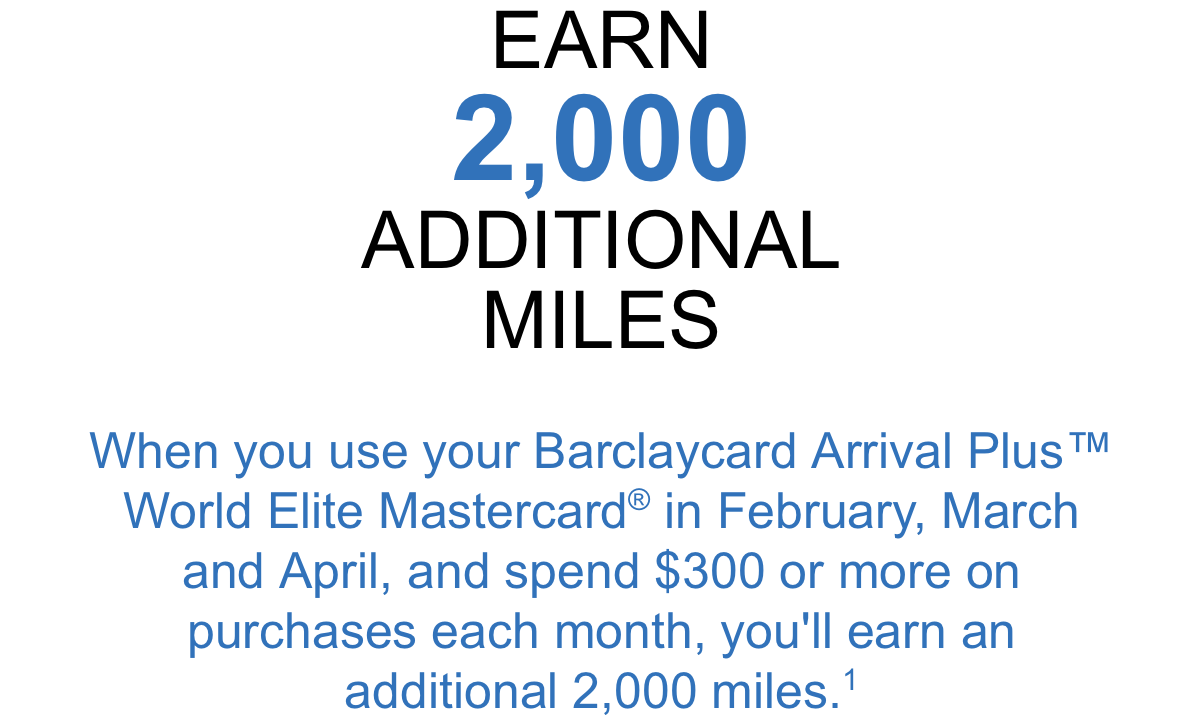

For example, earlier this year I received an offer for our Barclays Arrival+ card. I’ve kept this card because I want to stay on Barclays’ good side as a long-term customer. In addition, we’ll occasionally get a decent offer for bonus miles. The offer we received was for a 2,000-point bonus (worth $20) for spending $300 on the card for 3 months in a row.

Doing the math, for spending $900 we’d get 3,800 miles (or $38). That breaks down to a 4.2% return on otherwise non-bonused spending. I took them up on the offer and used the card to pay for the vet and kennel bills during our trips, which easily exceeded $300 per month.

The 2,000 bonus points were added to the account in May and I was surprised to see another email from Barclays with what appeared to be a similar offer. However, there’s one HUGE difference.

With this offer, we’ll earn the same 2,000 bonus miles but to get them, we have to spend $1,300 per month for 3 months.

Earning 2,000 bonus points for spending $3,900 is only 0.5% extra from the usual 2% return. In addition, I don’t want to move $1,300 in spending per month to my Barclays Arrival+ card. I’d rather spend that money on my Hilton Surpass AMEX or World of Hyatt card to get an extra free night.

So Barclays, listen up: I understand that you saw I took advantage of the last targeted offer because an additional 2.2% return was worth spending $300 per month. But I’m not going to spend $1,300 per month on a card for 2,000 extra points. For that amount, I could sign up for a new card and get a $700-$1,200 value for a sign-up bonus.

After passing on this offer, I’m curious to see what I’ll get next time…if I get any offer at all.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary