Chase has extended the Pay Yourself Back program for another 3 months. Pay Yourself Back allows Chase cardholders to redeem Ultimate Rewards points to offset expenses. Originally introduced in June 2020, this feature allowed credit card holders to redeem their points when travel wasn’t an option due to the pandemic. It was a way for Chase to keep cardholders interested in earning Ultimate Rewards.

In 2023, Chase reduced the program as travel was returning to pre-pandemic levels. Users resumed redeeming their Ultimate Rewards points for travel expenses or transferring them to one of Chase’s partners. There was little need to let them use Ultimate Rewards for other expenses. Although Chase lowered the bonuses and limited the categories, the Pay Yourself Back feature remains. Since then, Chase has been extending the offer every three months and recently announced the bonus categories that will be valid until March 31, 2024.

The bonuses and categories vary depending on your Chase Ultimate Rewards card. Here’s the link to access the Pay Yourself Back program. You can also access the program through chase.com or by using the Chase mobile app.

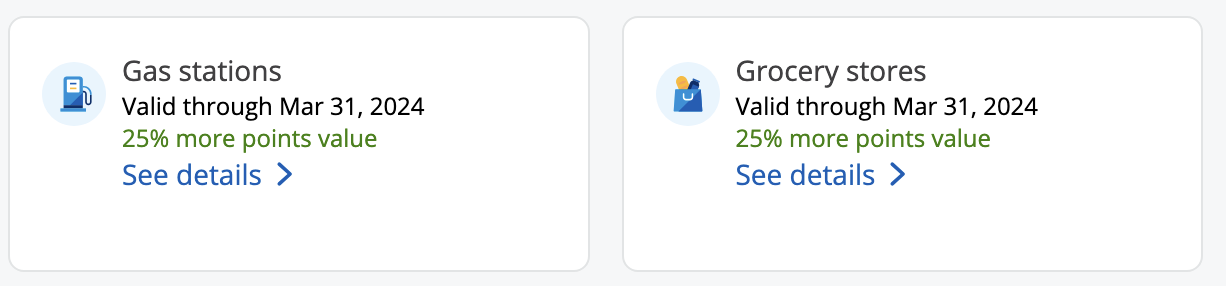

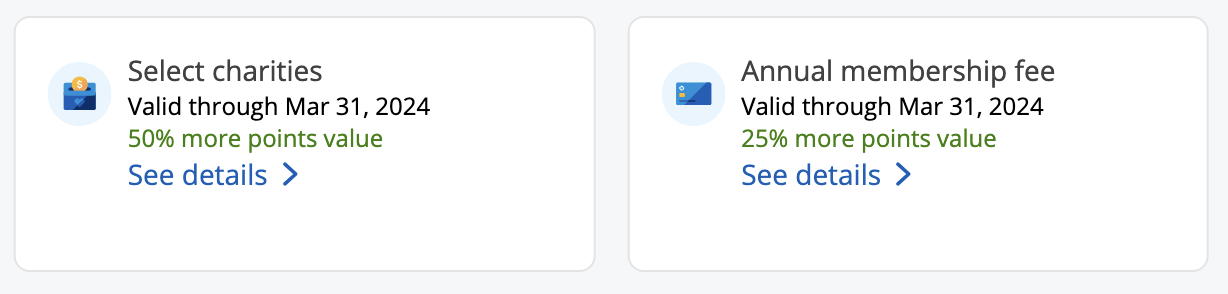

The largest bonuses are for Sapphire Reserve cardholders.

- Gas Stations – 25% bonus

- Grocery Stores – 25% bonus

- Select Charities – 50% bonus

- Annual Fee – 25% bonus

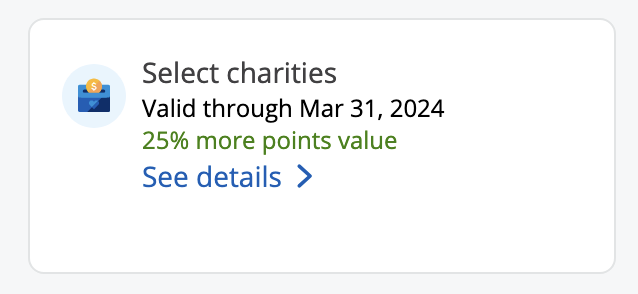

All other Chase Ultimate Rewards cards have one Pay Yourself Back category.

Sapphire Preferred, Chase Freedom (Flex, Unlimited & Original), & Ink Business (Premier, Preferred, Unlimited and Cash) cardholders can redeem points for select charities with a 25% bonus. For all cards, these are the charities eligible for Pay Yourself Back:

- American Red Cross

- Equal Justice Initiative

- Feeding America

- GLSEN

- Habitat for Humanity

- International Medical Corps

- International Rescue Committee

- Leadership Conference Education Fund

- NAACP Legal Defense and Education Fund

- National Urban League

- Out & Equal Workplace Advocates

- SAGE

- Thurgood Marshall College Fund

- United Negro College Fund

- UNICEF USA

- United Way

- World Central Kitchen

Final Thoughts

The Pay Yourself Back program, which allowed cardholders to redeem their Ultimate Rewards points for statement credits against certain purchases, was a useful feature. It provided an alternative to redeeming points for travel, especially during the pandemic when travel was restricted. However, recent updates reduced its value for most cardholders. The program now offers a 25% bonus for charitable donations, which is not as appealing as previous redemption options.

If you’re looking for better ways to use your Ultimate Rewards points, there are several options that offer more value. For example, you could consider transferring your points to travel partners like Hyatt, Singapore Airlines, United Airlines or Aeroplan. By transferring points to these partners, you can potentially get a higher value for your points. In general, transferring points to travel partners is a great way to maximize the value of your Ultimate Rewards points, especially if you’re planning to travel in the future.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary