When applying for a credit card, you’ll usually see a place to add authorized users. The banks will phrase it like, “ADD UP TO FIVE PEOPLE TO YOUR ACCOUNT FOR NO EXTRA CHARGE!” If you do this, the bank will send credit cards to everyone. Great, right? Maybe, maybe not. Here’s a quick rundown of what an authorized user is and why it may be a good or a bad idea to add one to your account.

It helps to understand what an authorized user actually is. When you have a credit card, you are financially responsible for all charges made to the card. An authorized user is an additional person you add to the account who is not legally obligated to pay any of the debt (charges) made to the account; the primary user (that’s you) is responsible for those debts.

There are no restrictions on who you can add as an authorized user to your account. You can add your spouse, your kids or grandkids, your parents or grandparents, your neighbor, your co-worker, your barista, the person who cleans your pool, or some stranger you met in line at the 7-Eleven. You can add them to your account as long as you have their information (and sometimes their Social Security number). Remember the rule from above before doing so – ANY charges they make to their card are your responsibility to pay back, not theirs.

When should you add an authorized user to your account? There are several times when it may be a good idea:

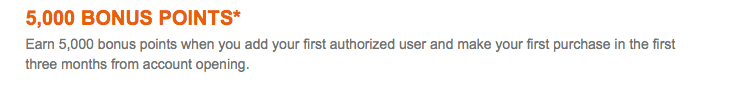

BONUSES

Banks will often provide a bonus for adding an authorized user, either during the signup application or after you have the card.

Banks want more of their cards out there for people to use. After all, you can’t charge things to a card if you don’t have the card in the first place. Depending on the offer’s value, it may be a good deal to add an authorized user to your card for this purpose. However, it does also have some downsides that I’ll discuss later.

Banks want more of their cards out there for people to use. After all, you can’t charge things to a card if you don’t have the card in the first place. Depending on the offer’s value, it may be a good deal to add an authorized user to your card for this purpose. However, it does also have some downsides that I’ll discuss later.

BENEFITS

Some credit cards, such as the American Express Platinum card, give excellent perks like lounge access when traveling. American Express charges $195 per additional users to the card. Each authorized user will then get access to the Centurion airport lounges, Delta Sky Clubs, and a Priority Pass Select membership. Each authorized user will also get credit for Global Entry or TSA Pre✓® every 5 years. If you add extra benefits like the automatic status at Hilton and Marriott, you can see there’s value in adding additional users. This makes even more sense if the primary and authorized users travel separately. Remember, anything charged to their Platinum card is your responsibility to make sure the bill gets paid.

Having an authorized user also makes sense if you want to take advantage of certain perks a particular card provides. If you add an additional user to a Chase Freedom or a Discover card, each user can maximize spending in the 5x bonus categories every quarter. Since these are both no-fee cards, there’s no additional charge for adding an authorized user to these accounts.

STRATEGICALLY COMBINE SPENDING

You may want to have an authorized user on your account to combine spending. This will make it easier to hit the minimum spending requirement when getting a new card or reaching a threshold, like the 30 transactions a month needed to trigger the 50% bonus on the American Express Everyday Preferred card.

KEEP TRACK OF SPENDING

Adding an authorized user to your account can help you keep track of the spending on those cards. This may be helpful if you want to give a card to one of your children or your parents. You can see their spending online and even set alerts to let you know every time they use the card if you think that’s necessary.

Giving an authorized user card to your child away at college allows them to have access to a credit line, say, in case of emergencies, or to buy those expensive textbooks that would be larger than they could get by themselves. It may also help them build a credit history, as long as you have a good credit history, to begin with.

THE DOWNSIDES OF AUTHORIZED USERS

There are some negatives when you add an authorized user to your card. Obviously, you are legally responsible for all charges made to the card, no matter who the person charging them was. So you have to make sure anyone you put on your credit account is responsible enough to handle their credit and respect yours.

I mentioned above how someone can become an authorized user on an account to help build their credit history. That’s because being an authorized user on a card may show up on your credit report. This is good for someone with little credit history but can be a negative if you want to apply for multiple cards for the signup bonuses since banks may limit the number of cards you can get in a specific time frame. Some banks, such as Chase, only allow you to get five new cards in 24 months. When you’re added to a card as an authorized user, it shows up on your credit report and may keep you from being approved. Now, you can call the bank and say you’re only an authorized user (and not responsible for the charges on the card), but it adds an additional hurdle to clear before getting approved.

FINAL THOUGHTS

Adding authorized users to your credit card accounts has both positives and negatives. In certain situations, it can be a huge benefit to add someone to your account. Still, you have to weigh the negatives of financial risk and the opportunity cost of getting other signup bonuses. As is often the case, Your Mileage May Vary.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

6 comments

[…] first authorized user and make your first purchase in the first three months from account opening. I’m not a big fan of adding authorized users and an extra 5,000 United miles might not be worth it if you are going to be applying for other […]

I’m very upset that I have tried and tried to sign up for flyer miles that’s why I applied for the credit card and I have purchased 4 tickets so far but am ready to cancel the whole thing because I can’t get my miles can someone please call and help me.

Sorry to hear about your difficulties getting your miles credited. Unfortunately we are not affiliated with any of the airline frequent flyer programs. I’d suggest contacting them directly with any concerns you have,

A parent with a good credit score can have children as authorized users, and simply by that, the children can have excellent credit scores, with no income. We’ve just lived through the benefits of this.

This is great advice. When I was 18, I needed a credit card but couldn’t get one on my own. I then discovered that American Express would give me a card. Eventually, I got enough of a credit history and credit cards also became easier for anyone to get.

One time, I even got a Saks Fifth Avenue credit card for my dog using only my dog’s name, not my name. I kept it as a gag but never used it or tried to scam Saks.

There are some situations where being an AU is a godsend. For example, when one person has almost the amount of miles for 2 awards but is just short and could be helped by transferring a few thousand miles. With Chase you can transfer Ultimate awards easily between each other. But Amex requires that the person needing the miles/points be an authorized user for at least 90 days before any points can be transferred. In the situation when one is applying for a Chase CC, it better to call the recon line and explain that such and such CC is an AU card.