I rarely apply for a credit card if I’m not sure I’ll get approved. I know that’s unheard of for some people who feel that if you’re not getting denials, you’re not trying hard enough. However, I’ve said how I take the slow and steady approach to credit cards, and while I’m not doing it on purpose, I’m often under 5/24.

Occasionally, I take a chance and apply for a certain credit card, even though I know I’m pushing the limits of what the bank allows. I’ve reached that point with Chase, where they’re not willing to extend more credit, so each approval means a reduction of the credit line from one of my other cards. I’m okay with this because I don’t need a huge credit limit on every card. I’d like a larger limit on my Sapphire Preferred, but I don’t need a huge limit on my IHG or Disney cards.

Our History with Barclays

While I know many people dislike dealing with Barclays, our experience has been the same as we’ve had with any other large credit card issuing bank. Sharon and I have kept at least one credit card open with Barclays since we opened our US Airways cards, which became the original American Airlines Aviator card after the merger.

Sharon kept her Aviator+ card because it was one of the few cards with a true Chip+PIN capability for international travel. She’s also had the JetBlue Plus card after applying for a large sign-up bonus. Most recently she applied for the Wyndham Earner Business card, giving her three Barclays cards.

I’ve kept my JetBlue Plus card open for several years and recently added an American Airlines Aviator Red card to my account. With two cards that have substantial credit limits, I knew it would be risky to sign up for another card so quickly after getting the Aviator.

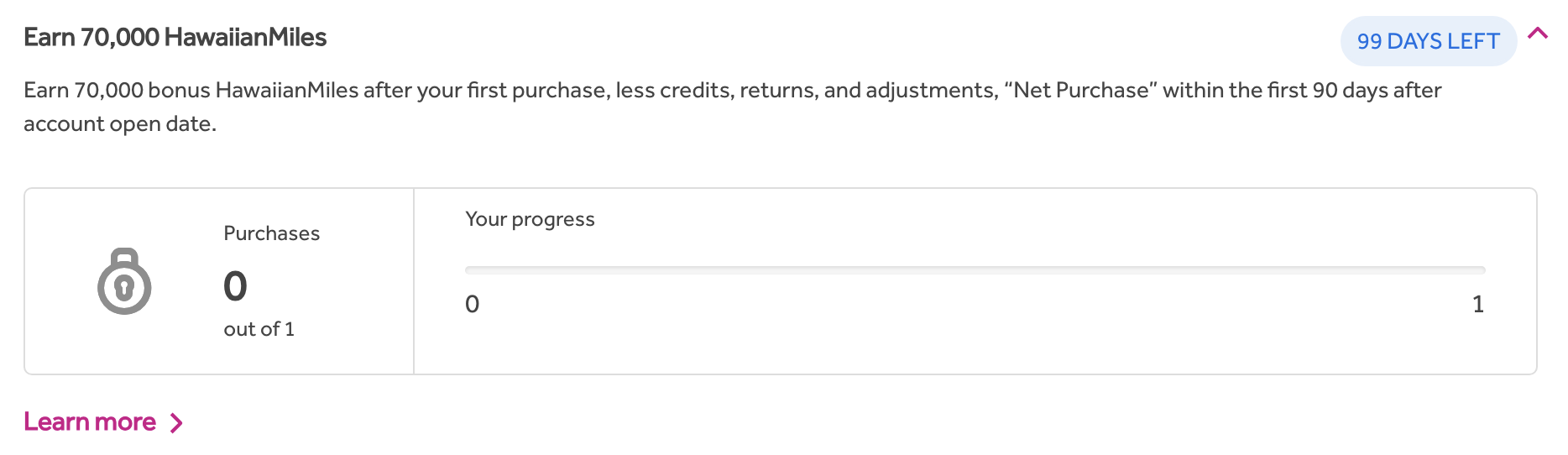

But I just couldn’t help trying to get some HawaiianMiles before the possible merger with Alaska Airlines. If the airlines merge, so will their loyalty programs and this could be a chance to pick up additional Alaska miles. The current HawaiianMiles credit card offer is for 70,000 miles after spending $2,000 and paying the $99 annual fee; it was worth the application even if I ended up getting denied.

Applying for the Hawaiian Airlines card

I was tempted to apply when I received a targeted offer in the mail for 70,000 HawaiianMiles after the first purchase. This is similar to the offer when you’re flying with Hawaiian. I applied online, and received the message I was expecting. My application was under review, and I’d hear from them with a decision.

While many people will immediately call to check on the application, I’m in the camp to wait and see what the bank is going to do. In my mind, all this message says is that a human has to look at my application before a decision can be made.

It took a few days, but I eventually received an email saying my application was approved and I should have my card in 7-10 days.

The Lowest Credit Limit Ever?

As we’ve signed up for more credit cards, some banks will approve our applications but only provide a small credit limit. When Chase approved Sharon for her IHG Premier card, they only gave her a $2,000 credit limit. That does make it challenging, but not impossible, to meet a spending requirement of several thousand dollars over a few months.

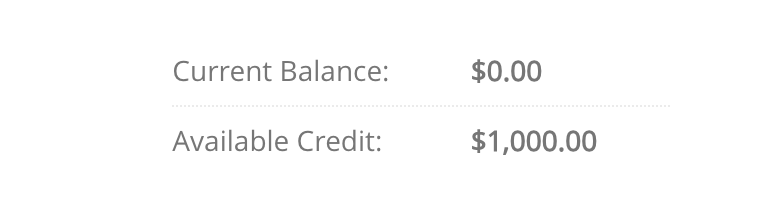

But Barclays has set a new bar for the lowest credit limit on a new card approval.

The email notifying me of the approval didn’t mention the credit limit. I had to log into my Barclays account to see the new card, and that’s when I saw my credit limit.

Barclays was willing to provide me with a $1,000 credit on my new HawaiianMiles card.

I’ve heard about the Barclays $1,000 credit limit on a new card approval. Most of the stories are about having to provide endless documentation to get a business card, only to be approved for a $1,000 credit limit. In this case, I was applying for a personal card and didn’t have to provide any additional documentation.

Why I’m not bothered

Am I offended by this? Of course not. I’m not close to using the credit that Barclays has extended to me on my other cards. Why should they extend more credit?

My concern would be if I needed to meet a spending requirement with such a low credit limit. However, the only requirement to earn 70,000 miles is to make a single purchase and pay the annual fee. I have to laugh that Barclays still puts a bonus tracker on my account showing I need to make 1 purchase in 99 days to earn 70,000 bonus miles.

Final Thought

Final Thought

While I’m not one to take chances with our credit cards, I was okay with taking a risk on this application. If Alaska ends up buying Hawaiian and merging loyalty programs, I’ll have purchased Alaska miles by paying the annual fee on the HawaiianMiles credit card. If, by chance, the merger falls apart, I’ll still have 70,000 HawaiianMiles, which are enough for two economy tickets to Hawaii.

While getting approved for a card with a $1,000 credit limit is humorous, it doesn’t matter, as my new card has no spending requirement to earn the bonus miles.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary