Thanks to the limited-time opportunity to turn American Express Membership Rewards into Alaska MileagePlan miles through transfers to HawaiianMiles, many people are learning about the AMEX Excise Tax Offset Fee. This fee of $0.0006 per point is charged for all transfers of Membership Rewards to U.S. airline programs: Delta SkyMiles, Hawaiian Airlines HawaiianMiles, and JetBlue TrueBlue.

I’m familiar with this fee as I occasionally transfer points to Delta. I’ll use points to book inexpensive flights since I usually get around 1.3 cents per point for SkyMiles, or even a better value since I save 15% from having a Delta co-brand credit card.

However, two questions about this fee come up the most: “What is an Excise Tax?” and “Why does AMEX charge a fee when other banks don’t?”

What is an Excise Tax?

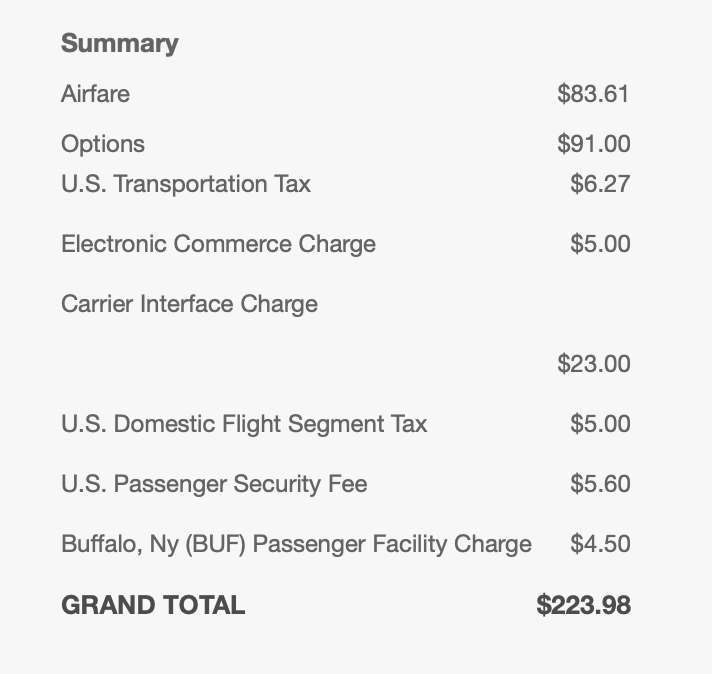

Every time you purchase an airline ticket, you pay an excise tax, which often appears as a “U.S. Transportation Tax” (on Frontier) or “Federal Excise Tax” (on Spirit). This tax, currently 7.5%, applies to all domestic flights based on the airfare price, but it excludes extra fees like baggage, seat selection, and fuel surcharges — which is why airlines itemize these fees separately.

In the late 1990s, Congress extended this excise tax to cover frequent flyer miles as well, so banks and airlines now pay the tax when they purchase miles for rewards programs. Rather than taxing individual award tickets, the tax is charged upfront when miles are bought in bulk.

How You Can See the Excise Tax in Action

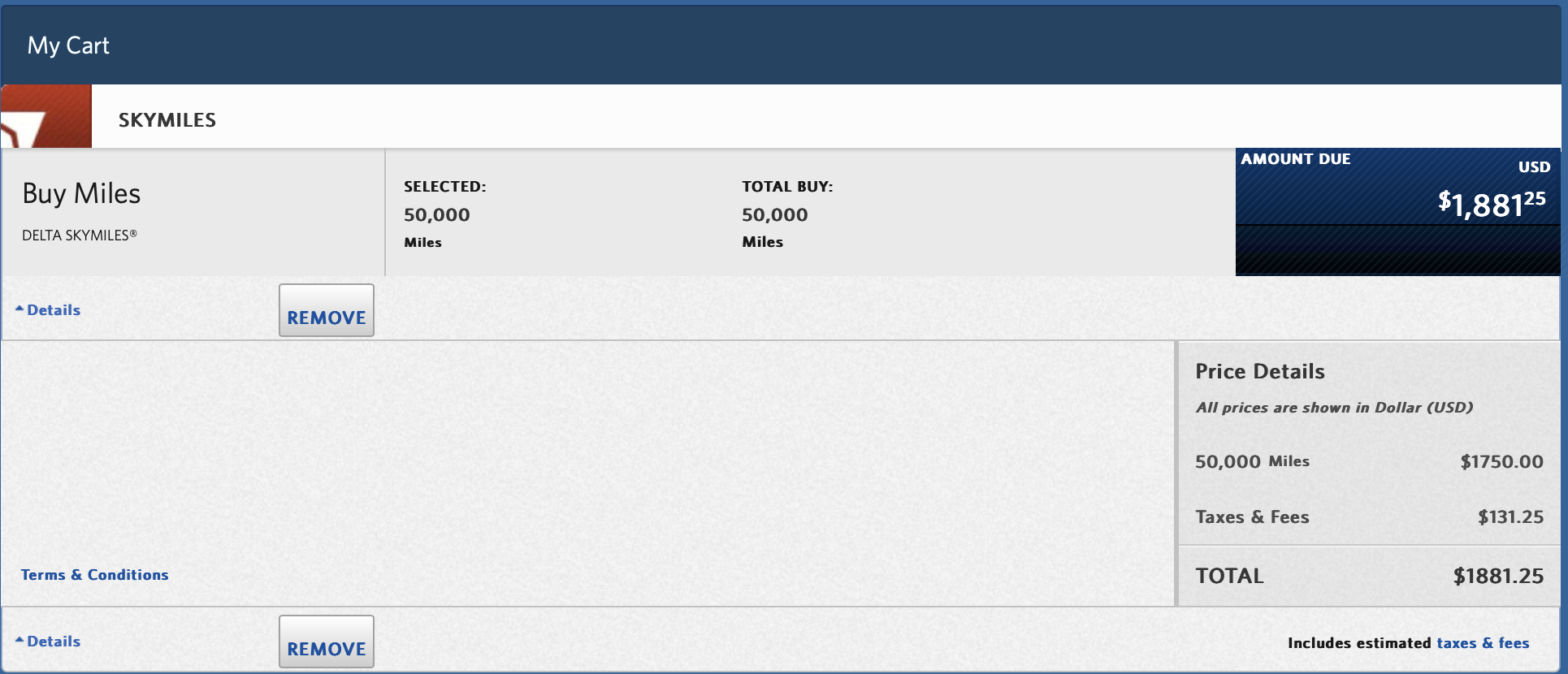

A simple way to see this tax is when you purchase miles directly from an airline. Although this is generally not a good value, let’s say you need to buy 50,000 Delta SkyMiles. Those miles would cost $1,750 (or 3.5 cents per mile). On top of that, you’d pay an additional $131.25 in excise tax, which is 7.5% of $1,750.

Now imagine this on a massive scale. Instead of $1,750, picture buying $6.5 billion in points, which is roughly what AMEX spent on Delta miles in 2023. Every time a bank buys miles from a U.S. airline, they pay a 7.5% tax on the agreed-upon cost per point with each airline.

Why Only AMEX Charges an “Excise Tax Offset Fee”

Although every bank must pay this tax on miles they buy from U.S.-based airline programs, only AMEX passes this cost to its customers, labeling it an “Excise Tax Offset Fee” rather than a “tax.” This terminology is intentional, as the fee AMEX charges customers ($0.0006 per point, up to $99) is only a rough estimate and may not reflect the exact excise tax paid on your specific points transfer. AMEX explains it this way:

“You’ll pay an excise tax offset fee ($0.0006 per point, up to $99) for points transferred to a U.S. airline frequent flyer program. This fee offsets the federal excise tax we must pay when you transfer points. It may be more or less than the actual amount of the excise tax we pay on any individual transfer.”

AMEX’s fee covers their tax costs when transferring points to Delta, Hawaiian Airlines, or JetBlue, but it’s an approximation, as calculating the exact tax for each transfer would be complex. While other banks like Chase, Citi, and Bilt Rewards absorb this tax cost instead of passing it along, AMEX has chosen to use the “Excise Tax Offset Fee” to recover some of these expenses rather than absorbing them fully.

Final Thought

Passengers pay an excise tax on all airfare, calculated as 7.5% of the ticket price on domestic flights. For frequent flyer miles, the tax is applied upfront when miles are purchased from U.S.-based airline programs, instead of tracking it on each award ticket. Whether it’s a customer buying a few thousand miles to top off an account or banks purchasing billions to fund credit card rewards, the government takes its share. Only AMEX chooses to pass this cost on as an “Excise Tax Offset Fee” when transferring points, while other programs like Chase, Citi, and Bilt Rewards absorb it on behalf of their customers.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

2 comments

Classic “because they can” junk fee like telecom recovery fees. Should there also be a Fee Disclosure Text Fee: “You’ll pay a $.00000007/mile Fee Disclosure Text Fee helping us offset the cost of a lawyer to write the fee disclosure text for the “Excise Tax Offset Fee” and for the fee disclosure text you’re reading now.”?

Excellent explanation of what these fees are, how they came about, and why they’re charged. I don’t agree with Amex passing this cost along to its customers, but at least they’re capped at $99. That can reduce the financial hit when transferring large numbers of Amex MR points to one of its domestic partners.