When we travel within the U.S., I don’t give much thought to travel insurance before the trip. I make sure to use a credit card with good travel protections, and if I rent a car, I use a card that acts as the primary coverage if there’s damage to the vehicle. For medical coverage, I’ll have my insurance card in my wallet if I get sick or, even worse if there’s some sort of emergency.

When traveling outside the United States, there are a bunch of things to think about. You need to reconfirm travel arrangements, make sure you have all the necessary travel documents and visas and arrange for your mail to be held, your pets to be looked after and everything else that goes through your head. It’s easy to forget that you should also consider buying a travel medical insurance policy for your trip.

That’s because even if your medical insurance reimburses you for expenses abroad, they will most likely be considered out-of-network charges with high deductibles and copays. If you have Medicare, you generally don’t have any coverage at all — although certain Medigap plans, such as Plan G or Plan F, may cover foreign emergency care up to a lifetime limit.

According to an article from Consumer Reports,

“Most domestic health plans provide limited coverage overseas and won’t cover prescriptions abroad,” says Margaret Wilson, M.D., chief medical officer of UnitedHealthcare Global, which is part of UnitedHealthcare, the largest health insurer in the U.S.

If your insurer does provide coverage for medical treatment you get in another country, the care is typically reimbursed at an out-of-network rate, which means higher out-of-pocket costs.

So while medical costs outside the U.S. may be lower than what we’re used to here, I don’t want to pay out of pocket if I need to see a doctor while I’m away.

How to find an insurance company

I don’t know about you, but I really don’t want to spend time searching around websites of insurance companies comparing policies. I’ve found that in this instance, using a comparison-shopping website works best for my needs. For many trips, I’ve used InsureMyTrip.com. I can’t say if they’re the best, easiest to use or the cheapest website but I’ve always been able to find coverages for our trips. All you need to do is plug in the information about your trip (countries visited, activities planned and dates of travel) and some personal information (the ages of the travelers is all they ask for a quote). The website searches for policies from many different insurance providers.

The default setting is for a comprehensive policy which includes:

- Trip delay, cancellation, and interruption

- Baggage delay or loss

- Accidental death

- Medical Evacuation

- Medical and dental coverage

- and other coverages

The site makes it easy to compare plans from different providers or even the various options from the same company. For our trip, I already have many trip protections from using our Ritz-Carlton Card for reservations, so I narrowed the search to medical policies.

The site makes it easy to compare plans from different providers or even the various options from the same company. For our trip, I already have many trip protections from using our Ritz-Carlton Card for reservations, so I narrowed the search to medical policies.

Medical Coverage Policies

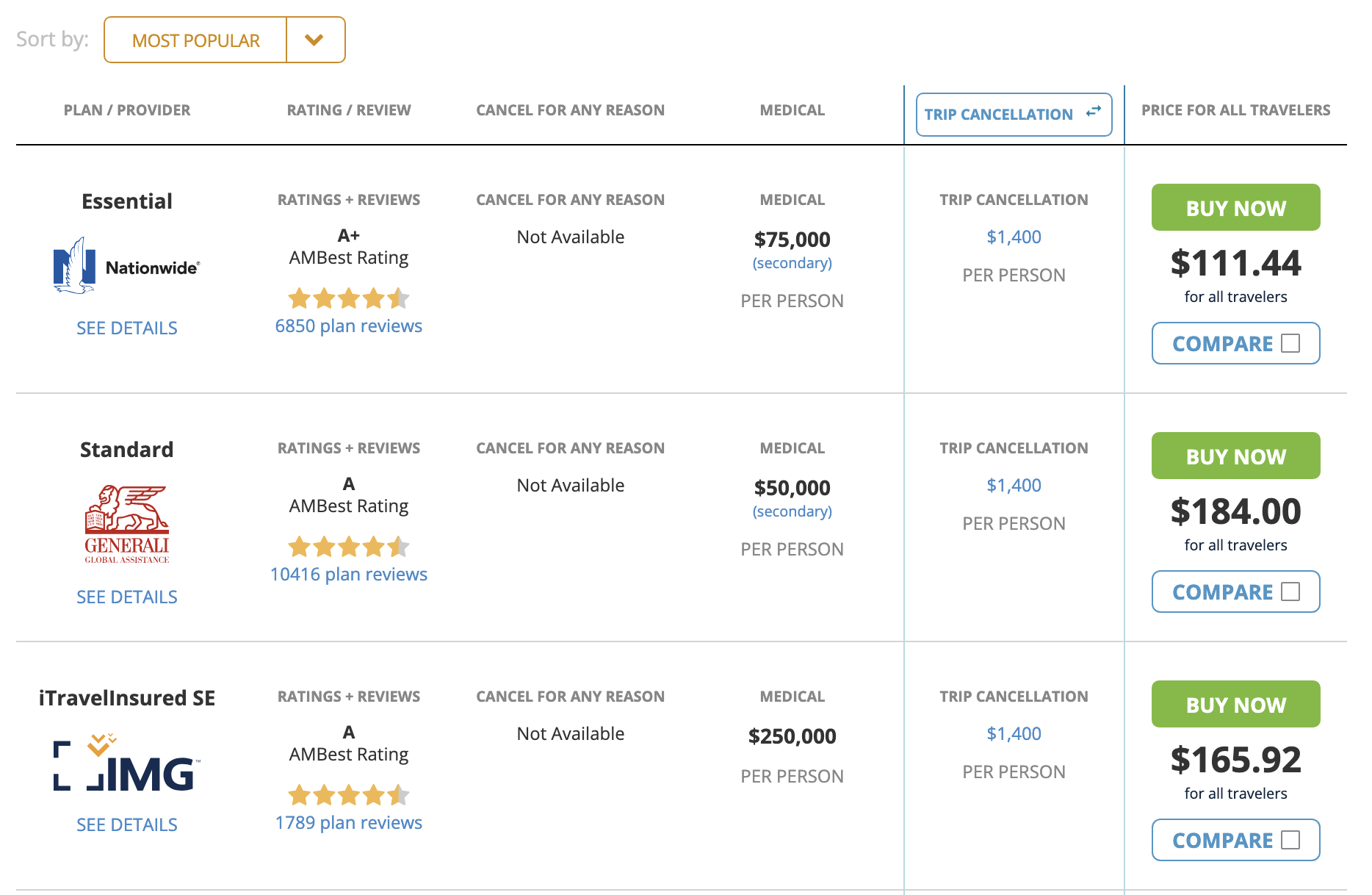

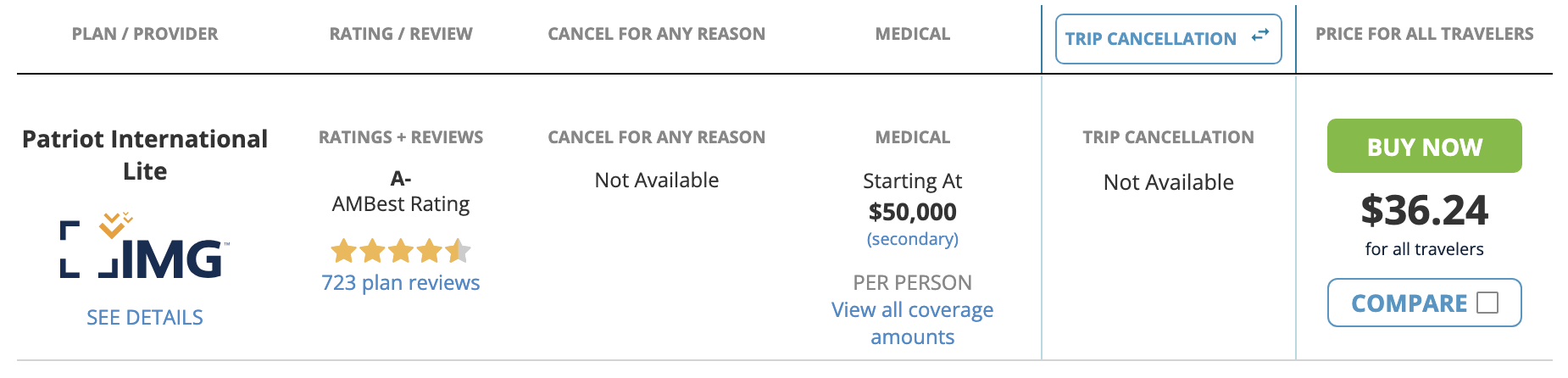

Eliminating travel protections brings down the prices. These prices are for the two of us on a 5-day trip. While these screenshots are from a previous trip, the pricing and comparison process on InsureMyTrip hasn’t changed much. Compared to the cost of the trip, medical insurance is a negligible additional expense.

Eliminating travel protections brings down the prices. These prices are for the two of us on a 5-day trip. While these screenshots are from a previous trip, the pricing and comparison process on InsureMyTrip hasn’t changed much. Compared to the cost of the trip, medical insurance is a negligible additional expense.

The premiums will vary based on your age, where you’re traveling, the level of coverage you choose and the duration of your trip. Several countries require you to have medical coverage to enter.

If you travel outside the U.S. several times a year, it may make sense to purchase a multi-trip policy.

Final Thoughts

I wouldn’t think of traveling outside the United States without having medical coverage. That doesn’t mean I haven’t forgotten until the day before the trip to purchase the policy. Fortunately, unlike getting other types of insurance, the process is quick and straightforward. I’m sure I might be able to find a better price if I went around and searched policies myself, but since the price is already relatively low, this is an instance where I’m happy to save some time even if I have to pay a few extra dollars.

While I usually use InsureMyTrip, there are other reputable travel insurance comparison sites like Squaremouth and TravelInsurance.com that work similarly. Regardless of which website you use, the most important thing is to make sure you have coverage in place, especially when traveling internationally.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

13 comments

I use InsureMyTrip for every trip; been doing it for years. Haven’t had to claim (thank goodness), but I feel I’m covered. I’m over 65 and am aware that Medicare does not cover overseas.

Ironically, while Medicare doesn’t cover costs outside of the U.S., health care costs in foreign countries are usually much lower than in the U.S., with results that are often just as good (or better).

Great advice. I read some people’s comments that assume other countries where there is “free” (although often rationed) healthcare also provide that for visitors. That isn’t the case at all and you could be stuck with a nasty bill (or in the case of Mexico and some other countries but required to pay $5000-$10,000 in cash before someone is treated). I frankly don’t care about most of the travel protections because I use points/miles for most which can be cancelled and have other coverage for flight disruption and lost luggage. Worst case it cost me something but I can afford it. On the other hand medical coverage can result in significant bills.

Recent example (and warn you this may be depressing to some) – my wife and I went on a trip to SE Asia with 5 nights in Taiwan, a 10 day cruise and then 3 nights in Singapore before returning to the US. Well all was going fine but she died on the ship in port while in Vietnam. Obviously a major personal loss that I’m still dealing with but also the travel insurance paid $18,000 to the transport company get her back to the US and over $13,000 in fees I incurred for medical expenses, some additional transport (off ship and from entry point in US to funeral home) along with trip interruption for hotels and airfare for me back to the US from Ho Chi Minh City. Overall, the experience was bad enough, I’d hate to get stuck with over $31,000 in costs in addition.

I’m going to Greenland next week, Europe for 12 days in the Fall and 3 weeks to Japan/Korea next February. I always buy a policy to cover me while out of the country.

I don’t understand why you would buy medical insurance, just pay for the treatment. Your options are better, there are no delays.

Some health insurance does have good international coverage. My insurance covers all international providers as in-network. It always pays to check your policy.

I think it is likely highly dependent on country etc. I’m American and run a program in Belgium every summer for 10-12 teenagers from around the world to spend 5 weeks in Belgium. About 40-60% of them are American’s

We require all our participant’s to show proofs

of medical insurance coverage that’ll work in Belgium this means most have to purchase the additional travel medical insurance.

The thing is, every time we take em to the doctor, go to the hospital for an x-ray, or have to get a prescription filled the cost is about €35.

The doctor will say something like “oh yeah you’re not in our healthcare system. It’s going to be expensive. I’m sorry.” And then we tell em it’s ok and that we’ll just pay the cash rate and submit to our insurance ourselves. Then they tell us “ok, that’ll be €35.” Sometimes it’s less. The conversation is the exact same at the pharmacy with the person filling out prescriptions.

As such, I really only want the coverage for the in case I get hit by a bus and spend weeks in the hospital.

I was hit by a bus in Paris. I was in the ICU for 7 days and left the hospital 6 day later. I added travel insurance (AIG) when I purchased my AA ticket. It was the best $28 I ever spent. It covered all my expenses which never hit the $25,000 limit.

I completely disagree with this and have been traveling internationally full time for six years at 68 years old. My regular U.S. Blue Cross policy covers me worldwide, although I do have to pay out of pocket and submit claims for reimbursement which I have done many, many times without issue.

The insurance I do buy is an annual evacuation policy with MedJet. A State Department employee recommended an evacuation policy to me as most insurance plans have insufficient coverage for evacuation.

My partner injured his hip in Patagonia and we had purchased travel insurance. However, the evacuation was an ordeal we would not want to repeat, and I will give you my insights on this process. Our travel insurance policy was activated within hrs of spouse’s admission to the hospital on Friday in San Martin. It was purchased through Square Mouth, an online “broker” that allows travelers to compare policy features from different insurance companies. Our policy was underwritten by Nationwide Mutual Insurance Company, and along with coverage for medical claims, lost luggage, trip delays, etc. included evacuation expenses of $1M.

Securing approval from Nationwide took layers of reviews; the time delay was not only physically painful but we knew a hip replacement would be necessary if surgery was not completed in 48 hrs. Try using a cell to reach the lone Square Mouth employee handling emergencies. Fast forward to call to AmEx. We have a platinum card. Within 24 hrs they had approval to send two pilots, a dr and EMT to fly spouse to US. Hip was replaced because of time delay. Lesson: just because you have medical insurance doesn’t mean getting coverage is easy or smooth process. The final claims were resolved with our state insurance commission; highly recommend as all insurance is regulated by state.

Medical evacuation insurance is very important also. It can cost over $100,000 to fly off an island or to get to a hospital that can handle your medical problem.

I disagree sinece I broke my back in May and paid not a dime at a French hospital. Please see my blog piece: https://tightwadtravel.blogspot.com/2025/07/my-broken-back-cost-much-less-in-france.html#more

Spend a week in an ICU abroad and you will realize that it isn’t inexpensive – I take out medical insurance for that reason.

I have used AARDY for years (no I do not work for them or get paid to promote the company). I can either do it all online or I can make a phone call and speak to a knowledgeable agent who find a policy tailored for my needs, as I also have many cc travel benefits that don’t need duplication.

Highly recommend.

The Chase Sapphire Reserve includes $2500 for emergency medical and dental when you are more than 100 miles from home, plus $100,000 for emergency medical repatriation.

I follow a couple of YouTubers who have been traveling for more than 8 years continuously. She needed a major surgery while in Kuala Lumpur a couple of years ago. She was scheduled, treated, spent 3 days in a private room at the hospital, provided all her follow-up needs, and the bill did not reach her $5000 deductible. As many have reported, costs abroad are far less than here in the US.