One of the easier ways to accumulate points is by taking advantage of “refer a friend” offers. The idea is a simple one. As a cardholder, you get a personalized tracking link that you can share with people who are interested in getting an American Express card. Your friend will get the advertised sign up bonus, and you’ll get a referral bonus once your friend is approved for the card by using your referral link.

For example, here’s our referral link to sign up for the Delta SkyMiles® Gold Business Card.

http://refer.amex.us/JOSEPHdnmA?XLINK=MYCP![]()

Each friend can earn up to 70,000 bonus Miles. Your friends can earn 60,000 bonus Miles after they use their new Card to spend $2,000 in purchases on their new Card in their first 3 months. Plus, they can earn an additional 10,000 bonus Miles after their first anniversary of Card Membership. Offer Expires: 04/01/2020. Your friend will be able to choose from all available Delta SkyMiles American Express Cards. You can receive your referral bonus no matter what Delta Card your friend is approved for.

Here’s what we get for the referral:

You can earn 12,500 bonus miles for each approved referral – up to 55,000 bonus miles per calendar year. Limited time offer ends 04/01/2020.

Sounds simple, doesn’t it?

One of our loyal readers asked me a question on Twitter about AMEX referral bonuses. She was concerned about using a referral link for her spouse and if that would draw the ire of the RAT Team. From what I know, they’re not churners, so I said I didn’t think AMEX would have a problem with it. One referral for a family member shouldn’t cause a problem. I warned that AMEX will claw back a bonus if you use your own referral link to apply for a card. Here’s a July 2019 post from Frequent Miler about that topic.

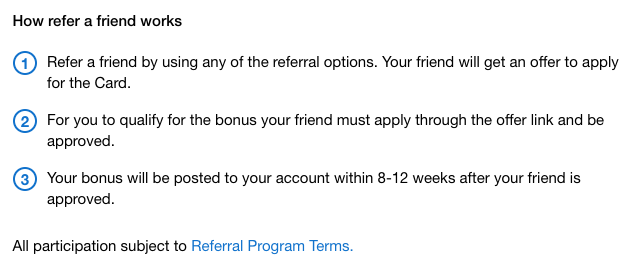

According to the AMEX website, referring a friend just takes three simple steps:

Since I was curious about this question, I clicked on the Referral Program Terms for the first time. Was I ever surprised?

Note that these terms were last updated on June 19, 2019. That’s less than a month from when the clawbacks of sign up bonuses began. Coincidence? I don’t think so.

The full terms are really long, so I’m not going to post the whole thing here. If you have an AMEX card with a referral link, you can click on the AMEX link to see the full terms.

Here are the rules that I found the most interesting and concerning. All boldface type and underlining are from me, for effect.

Eligibility.

This program is available online only to Basic Card Members. In order to receive a Referral Bonus, you must satisfy these Referral Offer and Program Terms and your Card account must not be canceled or past due on the date the Referral Bonus would post to your account and when you have qualified to receive the Referral Bonus.

So right off, AMEX says that if your account is past due on the day the referral bonus would have posted, you’re not going to get the bonus.

The value of the Referral Bonus may be taxable income to you. You are responsible for any federal or state taxes resulting from the Referral Bonus. Please consult your tax advisor if you have questions about the tax treatment of a Referral Bonus.

We already found out about this one when the banks started sending 1099 forms to cardholders for their referral bonuses.

In the Program Restrictions, there are a lot of things to unpack, but these stood out from the others. They’re not all of the restrictions, just the ones most pertinent to what we were discussing.

-

Your Card account’s eligibility to participate in the Refer a Friend program is based on your creditworthiness and other factors including your account history with American Express.

-

You are not eligible to participate in the Refer a Friend program if you have a history of referring friends who cancel their Card within their first three months of Card Membership

-

You are not eligible to participate in the Refer a Friend program if you have a history of referring friends who cancel their Card within their first three months of Card Membership, if you have a history of opening and closing American Express Cards, or if we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with any American Express offers or promotions in any way or that you intend to do so (for example, if you cancel or return purchases you made to redeem an offer)

-

This program intends for you to invite only your interested personal friends, family and known acquaintances to take advantage of the Card Offers above utilizing the referral link and sharing tools we provide. You may not share referrals with yourself.

So you can be banned from the referral program if you refer too many people who open and close cards within the first three months or if you have a history of opening and closing American Express cards. AMEX added in the same vague language they have in their card application page about abusing, misuse or gaming offers. I did notice they specifically mention the canceling or returning purchases made to redeem an offer. They also explicitly forbid self-referrals.

Lastly, American Express lets you know that they can change these terms at any time, and the only way you’ll know is the “Last Updated” date on the page will change.

Changes to the Program or these Terms

- American Express reserves the right to suspend, cancel, terminate or modify this program, these terms and conditions and/or any Offers made through this program at any time in our sole discretion.

- You are deemed to be aware of and bound by such changes by your continued access to or participation in the program.

- We will indicate that changes have been made by updating the “Last Updated” date located above at the beginning of these terms and conditions. If you do not accept any such changes, your sole and exclusive remedy is to cease participation in the program.

Final Thoughts

American Express has really started to crack down on its Membership Rewards and co-brand cards when it comes to sign-up bonuses. They’re not stopping there, as clawbacks for returning items or getting points from different offers are taking place, even if it’s only for a few dollars of value. I was surprised to see that AMEX will ban you from getting referral offers if the people that used your link are found to be abusers of the system in AMEX”s eyes.

Since I consider myself to be one to stay on the safer side of the points and miles playing field, I wasn’t anxious about the RAT team. However, I admit that I was extra cautious with my most recent AMEX application and made sure that I didn’t buy a single gift card (even my Starbucks refill cards) with my AMEX when I was meeting my spending requirement.

If AMEX has me worried about what legitimate charges I’m putting on a card or when a loyal cardholder is afraid about referring her spouse for a new card, those are signs that you may have overshot the target of cracking down on abusers and are now going after good customers. Unfortunately, I see no course correction in AMEX’s future, and the RAT team will find more and more ways to say we’re abusing the system to claw back points and close accounts, even if we weren’t doing anything wrong.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and get emailed notifications of when we post. Or maybe you’d like to join our Facebook group – we have 11,000+ members and we talk and ask questions about travel (including Disney parks), creative ways to earn frequent flyer miles and hotel points, how to save money on or for your trips, get access to travel articles you may not see otherwise, etc. Whether you’ve read our posts before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

1 comment

No fair! Your picture at the top shows an adorable kangaroo rat, not someone behind a desk cackling with glee while rubbing their hands maniacally together over taking points away from some poor sap.

Jokes aside, I really do think that Amex has gone overboard and given the direction they’re moving, they’re likely to continue making things worse for cardholders.