Citi’s credit card lineup is a bit of a mixed bag. The Citi Strata Premier is one of the best all-around cards, but beyond that, Citi’s offerings often have one standout feature rather than a well-rounded package. That makes it hard to justify getting a card for just one benefit.

The Citi Rewards+ card is one such example. It’s a no-annual-fee card that earns ThankYou points, making it a solid option for those who want to collect points without paying an annual fee. But does it deserve a spot in your wallet? Let’s take a closer look.

- Citi Rewards+ Card Details

- Earning ThankYou Points

- Redeeming Points

- 10% Points Rebate

- 0% Intro APR on Purchases & Balance Transfers

- Final Thoughts

Citi Rewards+ Card Details

Annual Fee

- $0 annual fee

Sign-Up Bonus

- Earn 20,000 ThankYou points after spending $1,500 in the first 3 months (with this link).

Foreign Transaction Fees

- 3% fee on international purchases. Best to leave this card at home when traveling abroad and use a card with no foreign transaction fees instead.

Earning ThankYou Points

The Citi Rewards+ earns ThankYou points.

- 2X points at supermarkets & gas stations (on up to $6,000 per year; then 1X points).

- 1X points on all other purchases.

- Round-Up Feature: Every purchase is rounded up to the nearest 10 points.

- Spend $1? Earn 10 points.

- Spend $991? Earn 1,000 points.

- While this sounds great, maximizing it isn’t easy. For example, spending $30.01 on gas instead of $30.00 earns 70 points instead of 60—a slight boost, but not always worth the effort.

- Limited-Time Special Travel Offer: For a limited time, earn 5X ThankYou® Points per $1 spent on hotels, car rentals, and attractions booked through CitiTravel.com. This offer is valid through December 31, 2025.

Redeeming Points

If you only have the Citi Rewards+ card:

-

- Redeem points for travel through the Citi Travel Portal (1 cent per point).

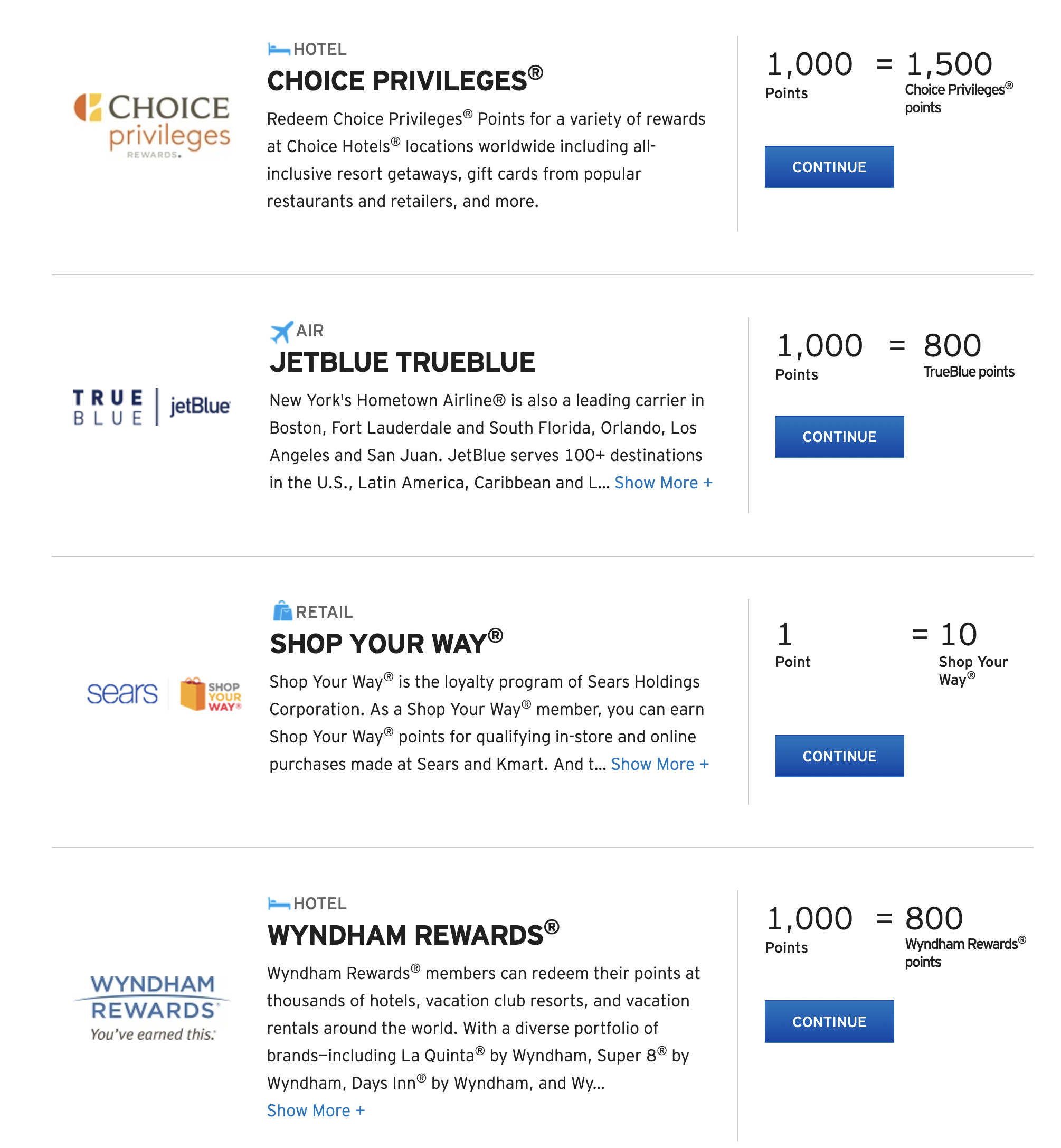

- Transfer points to a few partners:

- JetBlue, Choice Privileges, Wyndham Rewards, and Sears.

If you also have the Citi Strata Premier or Prestige:

- Transfer points to Citi’s full lineup of transfer partners, including:

- Aeromexico, Cathay Pacific Asia Miles, Avianca LifeMiles, Emirates, Etihad, EVA Air, Flying Blue (Air France/KLM), JetBlue, Qantas, Qatar, Singapore Airlines, Thai Airways, Turkish Airlines, Virgin Atlantic, Accor, Choice Privileges, Leaders Club, I Prefer, Wyndham Rewards, and Sears.

10% Points Rebate

- Earn a 10% rebate on the first 100,000 points you redeem each calendar year.

- Important: Transferring points to another Citi cardholder means no 10% rebate.

0% Intro APR on Purchases & Balance Transfers

- Purchases: 0% APR for 15 months, then 17.74% – 27.74% variable APR.

- Balance Transfers: 0% APR for 15 months (must transfer within 4 months), then 17.74% – 27.74% variable APR.

Final Thoughts

I keep the Citi Rewards+ card because it offers a 10% rebate on redeemed points, making it a valuable no-annual-fee option. Since I also have a Citi Strata Premier card, I can transfer points to partner programs, but I’ve also used them to book travel—like our flights to Iceland.

If you’re looking for an easy way to earn and redeem ThankYou points without paying an annual fee, the Citi Rewards+ might be worth considering.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

2 comments

I just product changed this CC to Citi Custom Cash. The Double Cash and the Custom Cash from Citi, are the 2 best cards to augment your stash of Thank You Points. I have 2 Custom Cash CCs that I use for home improvements only and the other for dining out. I easily clear 2-3K monthly of points for everyday purchases. Far better return on spend than any other CC.

I use the Custom Cash card to earn 5X for theater and concert tickets.