While some people who earn points and miles through credit card bonuses constantly try to push the limits of what banks will allow, that’s not my style. I prefer to take things slow and steady and be a good customer. This means I don’t apply for cards and cancel them after one year, and I try to have at least one card from each bank that we use on a regular basis (although this one is difficult when you have a drawerful of cards).

My wife Sharon and I have been American Express customers for over twenty years. She was a cardholder before I was, going back to her original Green Card, which she still has (and I’ve stopped giving her grief about it). I’m extra cautious when dealing with AMEX when meeting a spending requirement, so I avoid buying any gift cards – not even a $20 Starbucks card from the supermarket.

That’s why I’m shocked, but not surprised, that Sharon’s currently in AMEX Pop-Up Jail.

AMEX Pop-Up Jail

If you’re unfamiliar with the term, this isn’t some makeshift jail that AMEX has put into major cities as a promotional stunt. It’s a virtual prison where customers become ineligible for sign-up bonuses for American Express cards. It’s called “pop-up jail” because you only find out that you’re in it when you receive a pop-up box when applying for an AMEX card.

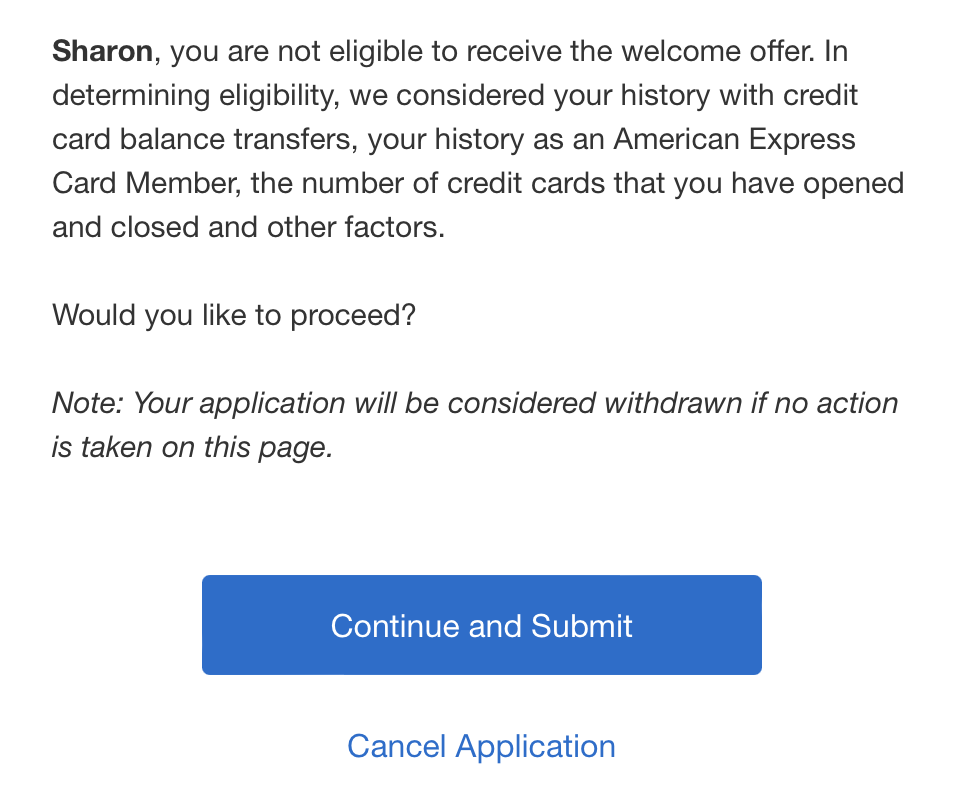

Sharon received this message when applying for a Delta SkyMiles AMEX card.

She received the same message when applying for the personal and business versions of the SkyMiles cards.

What Did She Do Wrong?

Like many of American Express’ rules, this one is purposefully vague.

In determining eligibility, we considered your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors.

This message refers to the language that American Express has added to their card applications. For example, here’s a section of the AMEX SkyMiles Platinum Card. Notice that it also includes the newer AMEX “little brother” rule.

You may not be eligible to receive a welcome offer if you have or have had this Card, the Delta SkyMiles® Reserve American Express Card or previous versions of these Cards. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.

So what did she do to end up in pop-up jail?

I’ve already mentioned Sharon’s history with AMEX, which goes back over twenty years, and she’s never done a credit card balance transfer. You might say it’s because she’s opened and closed too many cards, but she’s only opened two cards in the last two years, and they were business cards with Barclays and Chase.

She cancelled her Bonvoy Brilliant AMEX in 2023 when the annual fee increased to $650, but before that, the last AMEX card she closed was in 2020. That’s when she dropped her Gold SkyMiles AMEX to get the Hilton Surpass card.

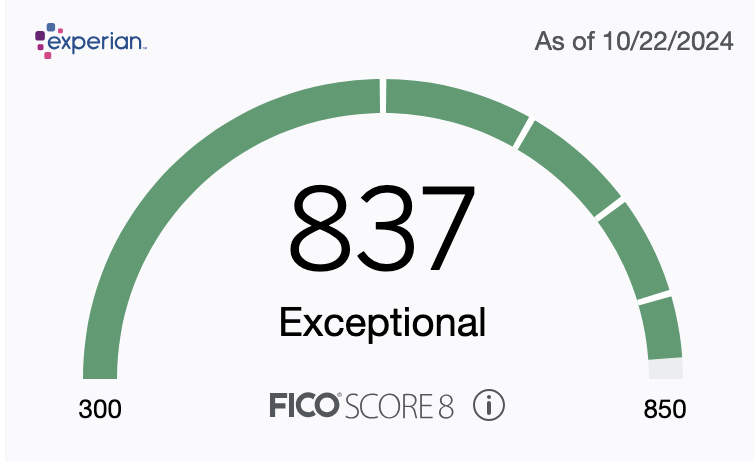

According to the information provided by American Express, her credit score is exceptional.

Finally, she uses her AMEX cards regularly. The Hilton Surpass AMEX is her everyday spending card. She’s spent over $15K on this card for the past two years to earn a free night certificate from Hilton that’s good at almost any property. Her other cards get occasional use, with our toll transponder charges going to the Green Card and various business expenses going to the Blue Business Plus.

What To Do?

While there are several articles and videos about how to get out of AMEX pop-up jail, the truth is that no one knows what you need to do. That’s because AMEX won’t tell you what you did to get put in jail. For most people, AMEX falls back on the “other factors” excuse. From what I read, there’s no one you can call to find out what’s wrong, and some people claim that they’ve been accepted for one type of AMEX card immediately after being rejected for a different co-brand card.

I’m not going to sweat it. If AMEX doesn’t want to give us a new card with a sign-up bonus, that’s their decision. Even if I considered putting $10,000 on the card to earn a $200 Delta Flight Credit.

There are plenty of other banks and cards out there. I don’t want to take the time or effort to figure out why AMEX put Sharon in pop-up jail and what we need to do to free her.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

2 comments

Just happened to me for the first time. Been amex member for 20 yrs and just got an AMEX Business Plat (250k offer) in July and got the popup for the Business Gold (200k referral offer). I go hard on Chase, but AMEX is stumping me

It sounds more like “she” than ” we”. The title makes it sound like both of you are in pop up jail, but the article only says your wife is in it.