We have a contender for the strangest new product launch amid a global pandemic. Back in August, JetBlue announced that they were partnering with Goldman Sachs to offer a new payment option. After reading more about it, I’m bewildered about who would use this new form of payment. I’m even more confused about why and how Goldman Sachs is getting into this market.

JetBlue and Marcus by Goldman Sachs® Announce Broader Availability of MarcusPay™ – An Option for Customers to Pay Over Time

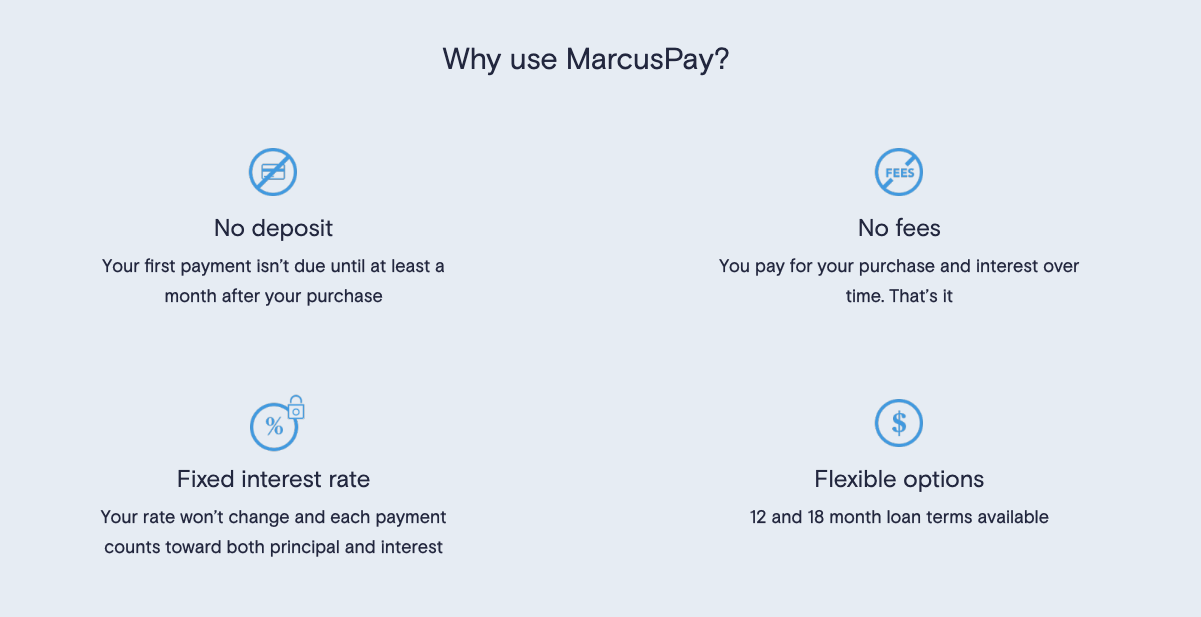

When buying a travel package or flights costing between $750 to $10,000 from JetBlue, you are given a choice to finance your purchase through MarcusPay, a personal financing loan branch of Goldman Sachs.

It’s a fact that Goldman is trying to expand its offerings in the personal finance arena, starting with the Apple Card that launched last year. While that was the financial powerhouse’s first credit card, MarcusPay appears to be a short-term financing option. It reminds me of when banks offer to consolidate your debt into a single loan. That’s precisely the business that Marcus is going for. That’s not the clientele I usually associate with Goldman Sachs.

The interest rate for a loan from MarcusPay ranges from 10.99% for those with excellent credit to 25.99% (ouch). The loan duration can be either 12 or 18 months. I don’t know how you feel about this, but to me this looks like the practices of a predatory lender. If you have good credit, you more than likely have a credit card with an interest rate of less than 25.99%. Even if you need to finance your vacation, paying that rate for a 12-months loan seems excessive.

Only the customers who are not able to get credit from any other source would be willing to pay those rates. Is that the financial bracket that you think of when you hear Goldman Sachs? I didn’t think so.

Every time I think about this new financing option, I shake my head. It’s not something I’d usually associate with JetBlue and not the type of financial instrument to come from Goldman Sachs.

Is there a market for this? I guess they both think there is. With so many people in financial hardship right now because of COVID-19, is this the time to start offering vacation packages with 25% interest? I’m glad I’m not the one running a bank or an airline right now so I don’t have to make these decisions.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and get emailed notifications of when we post. Or maybe you’d like to join our Facebook group – we have 15,000+ members and we talk and ask questions about travel (including Disney parks), creative ways to earn frequent flyer miles and hotel points, how to save money on or for your trips, get access to travel articles you may not see otherwise, etc. Whether you’ve read our posts before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

2 comments

You would have to be dumber than the dumbest rock to finance a vacation, especially paying interest! America cannot be this bad at saving money. You go on vacation with cash, not credit. Of course pay with credit but pay it off immediately.

Agreed, this financial product offering makes no sense. Seems as if an executive at GS was obligated to introduce some/any kind of new product in order to make his/her bonus for the year, and then reached into a grab bag and pulled this one out.

I could (maybe) see where Goldman and JetBlue offer no-interest financing on travel purchases for 3-6 months to those with good credit, in the hopes that it will stimulate demand. MarcusPay sounds like a dud, but who knows, maybe GS will make a mint on this (everything is strange in 2020).