The Citi Custom Cash card provides an excellent opportunity to maximize spending in categories that often go overlooked. Unlike other rewards cards, it’s the only one that offers a 5X bonus on live entertainment—a broad category that includes concerts, sporting events, theater tickets, and even amusement parks. This unique feature makes it an excellent choice for those who frequently spend in these areas and want to earn more rewards without paying an annual fee.

Why the Citi Custom Cash Card?

The Citi Custom Cash card is a no-annual-fee card that offers 5X ThankYou points on up to $500 of purchases in the category where you spend the most each statement cycle. The eligible categories include:

- Restaurants

- Gas Stations

- Grocery Stores

- Select Travel

- Select Transit

- Select Streaming Services

- Drugstores

- Home Improvement Stores

- Fitness Clubs

- Live Entertainment

This structure makes the card extremely versatile, as it adapts to your spending habits each month.

My Experience Using the Citi Custom Cash Card

I’ve primarily used my Citi Custom Cash card for concert and theater tickets, including purchasing tickets to see the final shows of Come From Away on Broadway.

The tickets weren’t cheap, but we earned 5X points on (most of) the purchase.

![]()

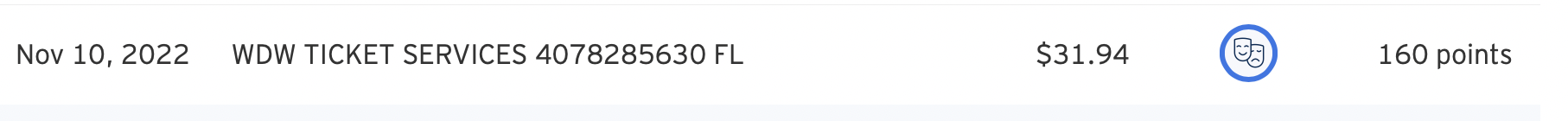

I also unknowingly took advantage of this category when paying for a reservation at Disney. Without thinking much about it, I used my Citi Custom Cash card for this charge, assuming none of my cards had bonus categories for theme park tickets. Later, I was pleasantly surprised to see that Citi categorized theme parks under “live entertainment,” qualifying my purchase for 5X points.

What Counts as “Live Entertainment”?

Citi defines “live entertainment” broadly, including:

- Concerts

- Live sporting events

- Live theatrical productions

- Amusement parks

- Orchestras

However, some exclusions apply, such as:

- Charitable organizations that provide live entertainment (e.g., benefit concerts)

- Sporting camps

- Sports complexes where you participate in the sport

- Public and private golf courses

- Country clubs (including membership fees)

- Bowling alleys

- Movie theaters

- Tourist attractions

- Museums and art galleries

Maximizing Points with the Citi Custom Cash Card

While the 5X earning is capped at 2,500 bonus points per month (from $500 in spend), the Custom Cash card still offers an excellent way to rack up points on high-cost purchases within the eligible categories.

To maximize the value of your ThankYou points, you’ll need a Citi card that allows for points transfers to travel partners, such as the Citi Strata Premier or Citi Prestige. Otherwise, your points can only be redeemed for cash back, gift cards, or travel through Citi’s portal at a lower value.

Final Thoughts

The Citi Custom Cash card is a fantastic option for those who want to optimize their spending in a category that rotates based on their highest expense each month. Whether you’re dining out, buying groceries, filling up on gas, or purchasing live entertainment tickets, this card can provide solid value without requiring an annual fee.

If you’re looking for an easy way to earn ThankYou points with strategic spending, this card might be worth considering.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary.

2 comments

Good to know. Thanks.

I have 2 Custom Cash CCs. For the exact reason you described. I changed a Citi Custom+ to Citi Custom Cash. I use one for live entertainment and the other for home improvements. Almost monthly, I earn 5k of TYP. I may regret changing the Custom+, but we shall see if I transfer any points in the near future. The 10% rebate of using points may be worthwhile in the future, but I am just accumulating points right now. Citi makes it very easy to product change accounts.